Buy These 3 Stocks That Insiders Love

It’s this column’s second consecutive week of two minnows and a monster. Routinely, stocks that trade for under $10 and have insider buying are highlighted. But… once again, it was a struggle to find three small fish keepers. There is nuttin’ wrong with a wallhanger (taxidermed trophy fish) now and then.

It’s this column’s second consecutive week of two minnows and a monster. Routinely, stocks that trade for under $10 and have insider buying are highlighted. But… once again, it was a struggle to find three small fish keepers. There is nuttin’ wrong with a wallhanger (taxidermed trophy fish) now and then.

If not for a lack of quantity, this big one might have gotten away.

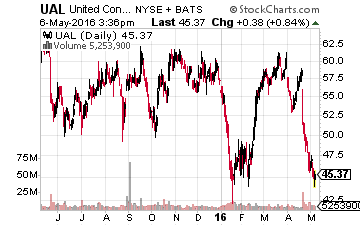

United Continental Holdings Inc. (NYSE:UAL) – Favorable Winds for Shifting Sentiment

For the past couple of years, UAL insiders did nothing but sell millions of dollars worth of stock. No doubt, some of which added to trophies of different sorts. So, when out of the clear blue sky like falling Manna, multiple executives and directors put sentiment in reverse and start buying shares, investors better pay attention.

For the past couple of years, UAL insiders did nothing but sell millions of dollars worth of stock. No doubt, some of which added to trophies of different sorts. So, when out of the clear blue sky like falling Manna, multiple executives and directors put sentiment in reverse and start buying shares, investors better pay attention.

United Continental Holdings provides air transportation services in North America, the Asia-Pacific, Europe, the Middle East, Africa, and Latin America. The company transports people and cargo through its mainline and regional operations.

At the end of April, the collective light lit for nine United Continental insiders and directors. They all decided to buy UAL shares in a two-day span; nothing but the sell button for two years and then pow. This group picks up 91,500 shares and spends almost $4.5 million.

The biggest spender was Director, Barney Harford, with 60,000 shares and a total outlay of $2.94 million. All told, two other directors and six executive team members, from the CFO to Executive VPs, joined Harford.

I can’t say for sure why this posse had a change of heart on UAL shares. However, industry trends are favorable for airlines as a group. The sector is reporting record profits thanks to more travelers, lower fuel costs, and rising fees.

Add in that insiders bought shares a few bucks off the 52-week low, and my guess is the nine see value in United Continental’s stock price combined with advantageous, economic and industry tailwinds.

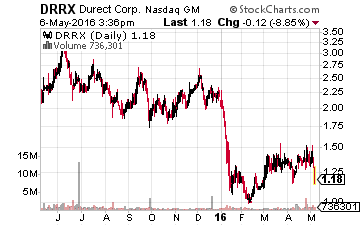

DURECT Corporation (NASDAQ:DRRX) – Pumping Up its Price

DURECT Corporation is a biopharmaceutical company that researches and develops therapies based on its epigenomic regulator program and proprietary drug delivery platforms. DRRX makes ALZET, miniature, implantable pumps that continuously deliver drugs, hormones, and other test agents at controlled rates for durations ranging from 1 day to 6 weeks. They also manufacture the LACTEL brand; polymers that are used for a variety of controlled-release and medical-device applications, and they are incorporated into several FDA-approved commercial products.

DURECT Corporation is a biopharmaceutical company that researches and develops therapies based on its epigenomic regulator program and proprietary drug delivery platforms. DRRX makes ALZET, miniature, implantable pumps that continuously deliver drugs, hormones, and other test agents at controlled rates for durations ranging from 1 day to 6 weeks. They also manufacture the LACTEL brand; polymers that are used for a variety of controlled-release and medical-device applications, and they are incorporated into several FDA-approved commercial products.

A pair of DURECT insiders made significant investments in the small/micro-cap biotech. Director, Dave Hoffmann, added 200,000 shares at a buck and quarter for a cool quarter-mill out-of-pocket.

And, Co-Founder, Chairman and Chief Scientific Officer, Dr. Felix Theeuwes, likes the $1.25 price tag as well, committing 200 grand for 160,000 shares. Considering his DURECT pay is roughly $217,000 a year, that’s a major acquisition.

Of the two, it is the co-founder’s previous action that gets the “what’s going on here?” juices flowing. Theeuwes has been buying, buying and buying dating back to November 2014.

His purchase prices have been lower and, at times, slightly higher than recent levels. Price is not the overriding factor here, in my opinion. Rather, it is that the Chairman’s investing habits line his personal interests squarely with investors’ interests. The man stands to lose or make millions of dollars based on DRRX’s fortunes.

This biotech has a pipeline of eight products in various phases with the FDA; a couple of which are on the doorstep of approval. It’s probably a pretty good bet that Hoffmann and Theeuwes believe the next 12-months will be peppered with FDA events/news that pumps up DRRX’s share price.

RELATED: How to earn 7% a year from a specialty bank in as little as 5 minutes.

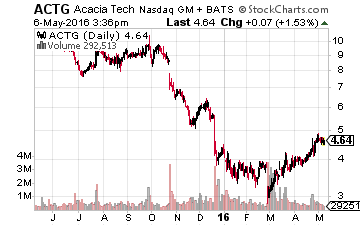

Acacia Research Corp. (NASDAQ:ACTG) – Protecting and Monetizing Shareholder Value

Acacia is a team of lawyers and technology experts that invests in, develops, licenses, and enforces patented technologies in the United States. ACTG helps their customers protect and monetize patents. So far, the company generated more than $1,200,000,000 revenue to date and has returned more than $705,000,000 to its partners.

Acacia is a team of lawyers and technology experts that invests in, develops, licenses, and enforces patented technologies in the United States. ACTG helps their customers protect and monetize patents. So far, the company generated more than $1,200,000,000 revenue to date and has returned more than $705,000,000 to its partners.

Three large insider buys suggest Acacia could protect and monetize shareholder value as well. This “cluster buy” totaled 110,000 shares for $462,679.

The roster of buyers includes the CEO, Marvin E. Key. The big boss ponied up $228,000 for 55,000 shares, nearly doubling Key’s ACTG position to 135,000 shares. Since then, the price climbed more 10%.

Perhaps, the trio sees Acacia trading at just eight times 2017’s consensus earnings per share (EPS) estimate of $0.58. That’s more than double this year’s forecast of $0.22. The average price-to-earnings (P/E) ratio for ACTG’s peers is 19.85. Using the average industry P/E and next year’s $0.58 estimate, Acacia would trade for $11.51.

That’s more than double the company’s recent price levels and meets the definition of protecting and monetizing shareholder value.

Bringing you back to reality, homeruns like that don’t come around often, and the majority of an investors’ portfolio should not be made up of risky positions like the three trades above. And, with the Federal Reserve punishing savers like they are right now, buying a safe CD that pays good interest is no longer an option.

So, what are investors to do with their portfolios?

Recently, Tim Plaehn, income expert with Investors Alley, met with the CEO of one of America’s fastest growing specialty banks, and what he told me just blew me away.

This bank didn’t take TARP money or other taxpayer bailouts–or any other bailouts for that matter–back in 2008 or ever.

This bank didn’t get tangled up in risky mortgage-backed securities, credit default swaps, stress tests, FDIC watch lists… you name it.

The CEO told Tim how his bank has been growing by leaps and bounds since even before the financial crash of 2008 and while impressive it’s not what stopped Tim in my tracks.

This specialty bank in America’s heartland is currently paying 7%.

He then shared with Tim exactly how his bank is able to pay so well and how everyday Americans (and Canadians!) can get in on this. Click here to find out.

Tim jotted down all of his notes and put them in this one report for you.

Click here for the full briefing that tells you exactly how and when to get started.

Note: Jared Nations is the author of this article.

Category: Penny Stock Alerts