6 Trades To Make If You Believe In Driverless Cars

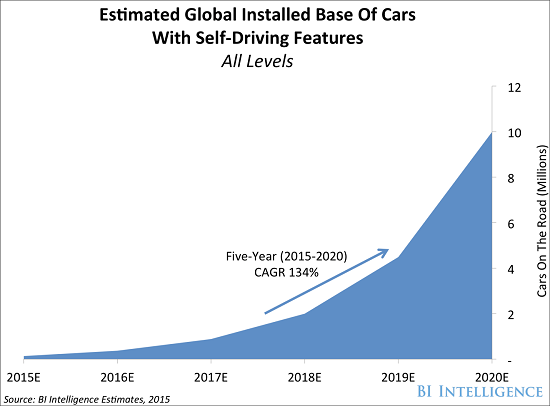

If you believe in a future where everyone will be using cars that drive themselves, then make these six trades to profit handsomely when that time arrives. With two million driverless cars hitting the road by 2018, that future may be closer than you think.

If you believe in a future where everyone will be using cars that drive themselves, then make these six trades to profit handsomely when that time arrives. With two million driverless cars hitting the road by 2018, that future may be closer than you think.

Imagine a new rule: Upon leaving high school, you are given an IQ test and the subsequent results. On receiving the results, you are asked whether you would like an official, forgery-proof tattoo of your IQ on your forehead. What would happen?

All it takes is a few of the high-IQ people opting in for the whole world to opt in. Here’s why: The initial adopters will inevitably be high-IQ people, as the display of a low IQ makes little sense. Once a few of these people tattoo their IQs on their foreheads, the remaining tattooed-free population now has a lower IQ – i.e., they lost some of the high IQ people from their population.

This means that, on average, a non-tattooed person has an IQ of under 100. If your IQ is over 100, you would benefit from getting your tattoo. High IQ individuals will tattoo their foreheads, further driving down the average IQ of the non-tattooed population.

After the 150s get their tattooed, 140s will be forced to get tattoos, lest they be lumped in with the sub-100s. This cascading phenomenon will drive everyone to get tattoos, even those with the lowest IQs. The cascading effect of everyone getting tattoos began because a few at the top decided to adapt to a new system.

Self-Driving Cars

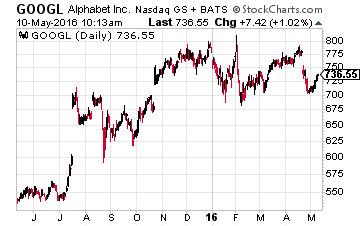

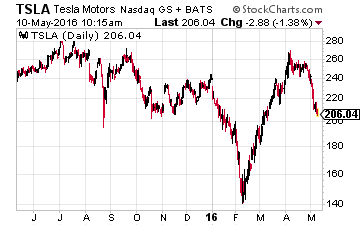

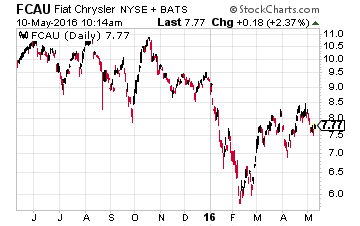

The self-driving car phenomenon is similar to that above. Companies such as Google (NASDAQ:GOOG), Telsa (NASDAQ:TSLA), and Fiat Chrysler (NYSE:FCAU) are pushing Congress and other policy-makers to make self-driving cars a thing. If successful, we could see the extinction of human-driven cars because of the same principle illustrated by the tattoo anecdote.

The self-driving car phenomenon is similar to that above. Companies such as Google (NASDAQ:GOOG), Telsa (NASDAQ:TSLA), and Fiat Chrysler (NYSE:FCAU) are pushing Congress and other policy-makers to make self-driving cars a thing. If successful, we could see the extinction of human-driven cars because of the same principle illustrated by the tattoo anecdote.

Here’s why this situation is similar to the IQ tattoo example. First, realize that self-driving cars are expensive. Think back to cars without computer chips or air bags: You could buy such a car for a couple hundred dollars.

Here’s why this situation is similar to the IQ tattoo example. First, realize that self-driving cars are expensive. Think back to cars without computer chips or air bags: You could buy such a car for a couple hundred dollars.

This is because you were buying an engine in a frame. With modern cars, profit margins are inflated through the addition of add-ons. Case-in-point: the cheapest Tesla at present is over $70,000.

That’s nearly $20,000 more than the average household income. The average driver will be unlikely to afford a self-driving car, which comes equipped with radars, sensors, complex software, and other gadgets. Those early adopters will be the wealthy.

The second stage relates to the insurance industry. Self-driving cars will lower insurance premiums because these cars have no human error involved. Insurance companies can logically increase the premiums on human drivers to subsidize the loss on self-driving cars.

The second stage relates to the insurance industry. Self-driving cars will lower insurance premiums because these cars have no human error involved. Insurance companies can logically increase the premiums on human drivers to subsidize the loss on self-driving cars.

The reason is simple – much like that of the Obamacare opt-out: If you choose to drive a human-driven car, you are taking an unnecessary risk. You put yourself and self-driving car passengers in danger, whereas self-driving car owners put no one at risk.

Over a long enough time, the insurance premiums will cost more than the purchase of a self-driving car. Thus, the switch from traditional, human-driven cars to self-driving cars makes financial sense for car owners. This will further eat away at car insurance companies’ profits until human driving becomes a luxury business.

How to Play

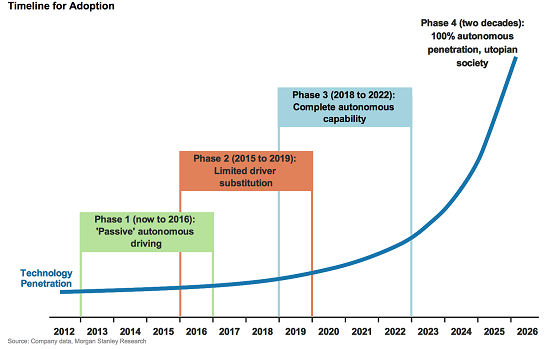

Much like empty foreheads, successful car insurance companies will become rare. Self-driving cars – or from the example “tattooed heads” – will become the standard. We are still a ways away from day zero of this shift, but investors have a habit of investing early.

The self-driving industry will grow while car insurance premiums fall. The idea is to go long on self-driving cars while shorting car insurance companies:

Long:

- Fiat Chrysler

- Tesla

Short:

But herein lies a problem: If we invest now, we might be too early; if we wait too long, we might miss out on the majority of gains in the industry. The self-driving car industry is a speculative industry in which to invest, seeing as we are in the beginning phases.

Buying these stocks outright could be risky. We could either end up as the early investors in Facebook (i.e., rich) or the early investors of eToys – the online company that was hyped to be able to run ToysRus out of business (eToys went bankrupt). That is, getting in early can bring us huge gains but also exposes us to losing all our capital.

Still, the profit potential is there, and missing out would be painful.

RELATED: How to earn 7% a year from a specialty bank in as little as 5 minutes.

The solution is to play this with long-dated options aka LEAPS. With LEAPS, you only invest as much as you are willing to place in a speculative trade such as this but you gain unlimited upside by mimicking 100 shares of the stock should our suspicions pay off. Let’s look at the leaps for TSLA for example:

The January 2018 TSLA LEAPS are currently selling for $4,440. This gives you access to 100 shares of a stock currently trading at around $215 – allowing you to avoid paying the full $21,500. If TSLA is successful in the automated car business and shares take off in response, we will likely profit.

We will break even when TSLA hits $264. If TSLA grows past $264, we make $100 per $1 increase in TSLA stock price. To double our investment, we only need TSLA to hit $300, which should be easy in 2018, when two million self-driving cars hit the road, as estimated by Business Insider:

In conclusion, with LEAPS you need not worry about either “getting in too early” or “missing the boat.” With an intelligent thought on the future of the market and the forward-thinking of placing a small amount of capital on a LEAP, you gain exposure to an industry ready to take off. LEAP buyers are the early adaptors of stock trading.

While using options trades like the six above are a great way of lessening the risk of investing in revolutionay technology, they do not replace owning high-quality income stocks that you can buy and hold forever. In the market right now there are a limited amount of options for investors looking to earn a growing income stream from safe investments. And, with the Federal Reserve punishing savers like they are right now, buying a safe CD that pays good interest is no longer an option.

So, what are investors to do with their portfolios?

Recently, Tim Plaehn, income expert with Investors Alley, met with the CEO of one of America’s fastest growing specialty banks, and what he told me just blew me away.

This bank didn’t take TARP money or other taxpayer bailouts–or any other bailouts for that matter–back in 2008 or ever.

This bank didn’t get tangled up in risky mortgage-backed securities, credit default swaps, stress tests, FDIC watch lists… you name it.

The CEO told Tim how his bank has been growing by leaps and bounds since even before the financial crash of 2008 and while impressive it’s not what stopped Tim in my tracks.

This specialty bank in America’s heartland is currently paying 7%.

He then shared with Tim exactly how his bank is able to pay so well and how everyday Americans (and Canadians!) can get in on this. Click here to find out.

Tim jotted down all of his notes and put them in this one report for you.

Click here for the full briefing that tells you exactly how and when to get started.

Note: Damon Verial is the author of this article. Coupling statistics with fundamental analysis, Damon has the goal of revealing to you the hidden patterns within stocks so that you may do what you wish with that information.

Category: Breaking News