4 Russian Stocks Feeling The Pain

President Trump’s relationship with the Kremlin makes Russian stocks uneasy

President Trump’s relationship with the Kremlin makes Russian stocks uneasy

On Nov. 9, 2016, Russian stocks became no-brainer investments. Throughout the campaign trail, then-real estate mogul and reality TV star Donald Trump promised a friendly posture to Russia. On more than one occasion, Trump praised Russian President Vladimir Putin for being strong and smart.

For traditional Republicans, Trump’s pro-Russia stance was disconcerting, to say the least. The great Ronald Reagan once said, “Mr. Gorbachev, tear down this wall!” In contrast, Trump stated at a campaign rally, “Wouldn’t it be nice if actually we could get along with Russia?”

Reagan used a no-nonsense, direct to the point, active voice when addressing former Soviet premiere Gorbachev. Trump surprisingly used passive, almost acquiescent, voice to address U.S.-Russia relations. This being the first time in recent memory that the White House was poised to become so openly friendly to Russia, investing in Russian stocks seemed like a foregone conclusion.

To be sure, Russian stocks took off like a bat outta hell when Trump became President-elect. No doubt Putin and company were ecstatic at the news. But as the Trump administration settled into its role, it became clear that this was no easy “bromance.”

American foreign policy routinely conflicted against Russia. Congressional leaders are fiercely critical of President Trump’s Russian stance, including prominent Republicans. And just recently, U.S. Secretary of State Rex Tillerson eschewed his personal friendship with Putin and demonstrated a strong show of support for Ukraine.

Rather than a renaissance for Russian stocks, we’ve seen the opposite. The region’s publicly-traded companies are among the worst performers this year. Despite the pleasantries that were exchanged recently between President Trump and Putin, actions speak louder than words.

Unfortunately, that means Russian stocks are facing lean and challenging times.

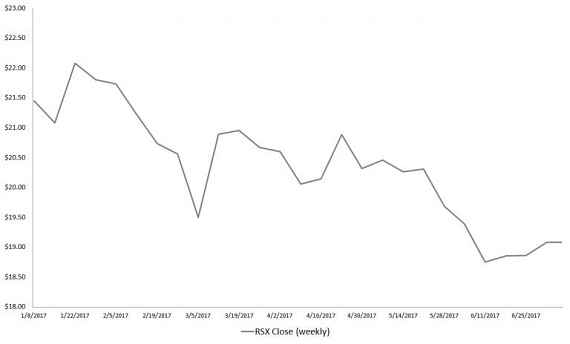

Russian Stocks: Market Vector Russia ETF (RSX)

For most investors of Russian stocks, the Market Vector Russia ETF Trust (NYSEARCA:RSX) is one of the first places they’ll look. With a broad range of blue-chip companies focused largely on energy and commodities, RSX is the quintessential Russian investment. Whenever anything has the potential to impact the nation’s economy, RSX is the chart to pull up and analyze.

Thus, it was no surprise that the Russia fund skyrocketed when Trump won the election. Between Nov. 8 and the end of December 2016, the RSX fund gained a massive 17.6%. Naturally, enthusiasm was off the scale, with many people jumping on the easy trade. Although January was somewhat volatile, RSX demonstrated bullishness towards the end of the month.

But since then, the Russia fund became nothing but a heartache. On a year-to-date basis, the RSX is down 9%. None of the platitudes that President Trump or his counterpart Putin expressed have meant much for Russian stocks. Instead, we’re seeing bearishness heaped on top of bearishness.

The unfortunate reality — from an investment perspective — is that while the president may be sincere in his goal to restore U.S.-Russia relations, he has to navigate Washington politics. And as much of a gunslinger as he is, Trump needs political support to have a chance at reelection.

So for all the jokes (and fears) about making Russia great again, it has come to naught for the RSX.

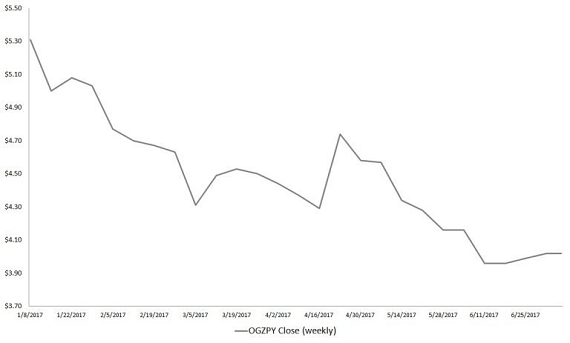

Russian Stocks: Gazprom PAO (ADR) (OGZPY)

No individual name represents Russian stocks greater than Gazprom PAO (ADR) (OTCMKTS:OGZPY). The name is synonymous with the country’s vast natural resources. It’s also prominently appeared in a number of Russian-hosted international events, signaling a new era of economic prominence. When U.S. Senator John McCain derisively referred to Russia as a “gas station masquerading as a country,” he was probably thinking about Gazprom.

Love it or hate it, OGZPY is a powerhouse entity, not unlike our own Exxon Mobil Corporation (NYSE:XOM) or Chevron Corporation (NYSE:CVX). Indeed, the primary reason why our government’s imposition of Russian sanctions is so tricky overseas is that OGZPY is one of Europe’s main energy suppliers. In Ukraine, its citizens would freeze without Russian natural gas supplies. Inevitably, this kind of leverage allows Putin to be Putin.

Ironically, it’s President Trump who might put an end to Kremlin shenanigans. In a recent speech in Poland, Trump asserted that the nation and its neighbors are “…never again held hostage to a single supplier of energy.” That supplier is Russia, or namely, OGZPY. While the Kremlin might dismiss this remark as empty rhetoric, the president authorized the Secretary of State to visit Ukraine. This move is hardly conducive for improving relations under Putin’s terms.

What it all boils down to is that Russian stocks are no longer a sure bet. OGZPY now knows this reality all too well.

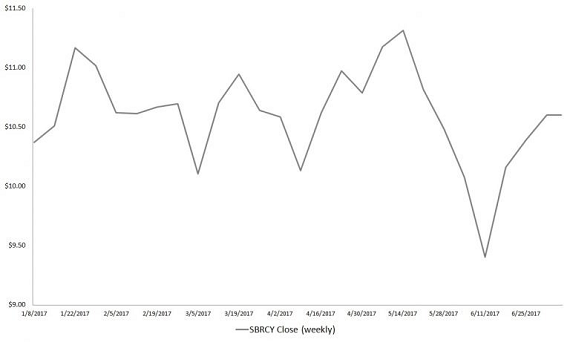

Russian Stocks: Sberbank Rossii (SBRCY)

During the campaign cycle, the idea of friendly U.S.-Russia relations was, in my opinion, more important to the Russians. As the world’s sole superpower — and its police officer — we Americans are used to dictating terms without consequence. The Russians, though, are not, as evidenced by the impact of western-led sanctions. Theoretically, a Trump administration was supposed to benefit companies like Sberbank Rossii PAO – ADR (OTCMKTS:SBRCY) due to normalization.

So long as the American public generally views Russia through historically tinted lenses, Russian institutions would never be fully trusted. But if Trump became president and helped shift the paradigm of perception, the thinking went, Russian stocks would lose their cultural stigma. This assumed normalization was part of the reason why SBRCY jumped as high as it did after the election.

Unfortunately, SBRCY stock only enjoyed a short-lived victory. After closing out 2016 with an incredible 103% return, investors expected bigly things from Sberbank. Unfortunately, it is becoming the “fake news” of the markets. Rather than benefiting from a new renaissance in U.S.-Russia relations, President Trump has been rather annoying to the Kremlin. As a result, SBRCY is down 7.2% YTD.

A little volatility is to be expected for every company. However, the ugliness in the SBRCY bear channel is undeniable, and signals caution to would-be buyers.

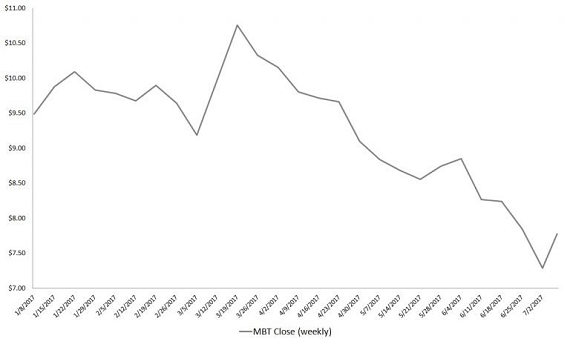

Russian Stocks: Mobil’nye Telesistemy PAO (ADR) (MBT)

You don’t have to be an energy exporter or financier to be hurt by economic sanctions or President Trump’s less-than-stellar improvement of Russian relations. Telecommunications giant Mobil’nye Telesistemy PAO (ADR) (NYSE:MBT) proved that you can be in an innocuous sector, and still be punished. But the woes impacting MBT have less to do with Trump and more to do with Russian infrastructure.

Simply put, MBT is a victim of Russia’s declining middle class. Too much of the economy is based on commodity and energy prices. The lack of diversification hurt badly when western nations sanctioned Russia for its annexation of Crimea. The resulting ruble inflation dramatically affected the middle class because wage growth could not keep pace. According to a Sberbank survey, 14 million Russians were pushed out of the middle class late last year. Many of them are just getting by on government dole.

No matter how you cut it, the middle-class pain is a significant headwind for MBT. A majority of Russians polled in September 2016 believed that saving money was critically important. Obviously, this impedes potential sales of MBT equipment and accessories, as well as premium services like pay TV.

Clearly, things haven’t improved at all this year. After a promising rally following President Trump’s victory, MBT is down nearly 15% YTD. Much of the hemorrhaging is a recent development. Since the beginning of April, MBT has lost more than 25% of market value.

Like so many other Russian stocks, there’s no more love for MBT.

Note: Josh Enomoto is the author of this article. As of this writing, Josh did not hold a position in any of the aforementioned securities.

See Also From InvestorPlace:

- 10 Value Traps to Avoid at All Costs

- 8 Mergers That Could Dethrone Amazon

- 5 Stocks Recommended by the Top-Performing Analysts

Category: Penny Stock Alerts