3 Zombie Stocks Back From The Dead

Being from western Pennsylvania, I am quite familiar with the whole idea of zombies. One of the great cult horror film classics, directed by the late George Romero, was the 1968 film Night of the Living Dead.

Being from western Pennsylvania, I am quite familiar with the whole idea of zombies. One of the great cult horror film classics, directed by the late George Romero, was the 1968 film Night of the Living Dead.

The story centered on seven people trapped in a rural western Pennsylvania farmhouse that are attacked by a growing number of “living dead” monsters – zombies. Much of Night of the Living Dead was filmed just miles from my home.

The takeaway from the film is that you want to stay away from zombies. But that strategy does not work all the time when we are talking about ‘stock market zombies’ – companies left for dead by Wall Street and abandoned by shareholders. Sometimes these companies come back to life, offering you juicy profit opportunities, if you’re not scared off by Wall Street telling you to stay away.

I want to tell you now about three such zombie companies in the technology sector that seem to coming back to life after Wall Street had administered the last rites.

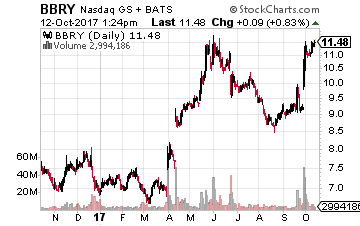

Zombie Stock #1 – Blackberry

At the top of my zombie list is Blackberry (Nasdaq: BBRY). We all remember this former phone maker and its many so-called “crackberry” addicts. And we all know that Apple and other phone makers pushed Blackberry phones into the dustbin of technology history.

At the top of my zombie list is Blackberry (Nasdaq: BBRY). We all remember this former phone maker and its many so-called “crackberry” addicts. And we all know that Apple and other phone makers pushed Blackberry phones into the dustbin of technology history.

But you may have missed the fact that Blackberry the company is back as a software and services company and doing quite well, thank you. Blackberry expects its software and services revenues to grow 10% to 15% in the current fiscal year. And it has $2.5 billion of cash on its balance sheet, not normal for a ‘zombie’ company.

The plan from CEO John Chen to shift to software and services related to mobile products looks as if it is starting to pay off. In its latest quarter, Blackberry reported revenues ($249 million vs $229 million) and earnings (5 cents vs zero) above expectations. Chen said: “We achieved historical highs in total software and services revenue and gross margin, as well as the highest non-GAAP operating margin in over five years.”

This is not a one-off fluke either. There are 60 million vehicles on the road that use Blackberry’s software. The company has struck deals with the likes of Ford (NYSE: F) and others. The continued push toward driverless cars should continue to benefit Blackberry. Chen expects fiscal 2018 to see revenues of between $920 million and $950 million for Blackberry and for it to be profitable and cash generative.

Blackberry looks to be a great turnaround story. But here is what really first attracted me to the stock… it is a favorite of the “Warren Buffett of Canada”, Prem Watsa.

For those of you unfamiliar with him, he formed Fairfax Financial (OTC: FRFHF) in 1985. Like Berkshire Hathaway (NYSE: BRK.B), insurance is at the core of a multitude of other investments.

Prem Watsa’s $14.5 billion Fairfax Financial has been able to increase its book value per common share by 20.4% annually since 1985! The stock has nearly kept pace, compounding at a nearly 20% annual rate. A mere $1,000 investment into Fairfax Financial in 1985 is worth in excess of $200,000 today.

Currently, Blackberry is his top investment, with a total of 46,724,700 shares held. That alone is reason enough for me to believe in the Blackberry turnaround story. Its stock is up 65% year-to-date and 44% over the past year and I expect this ‘zombie’ to continue to outperform.

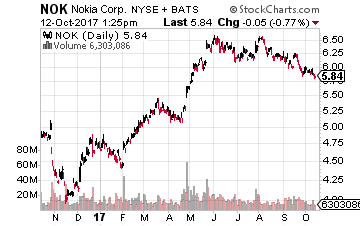

Zombie Stock #2 – Nokia

Another company on the list is Nokia (NYSE: NOK). The Finnish company was the dominant mobile phone player… until it missed the entire move toward smartphones. And you guessed it – Wall Street has swept it out and it sits next to Blackberry in the trash pile.

Another company on the list is Nokia (NYSE: NOK). The Finnish company was the dominant mobile phone player… until it missed the entire move toward smartphones. And you guessed it – Wall Street has swept it out and it sits next to Blackberry in the trash pile.

But the company has a long history of re-inventing itself. It began in 1865 as a wood pulp mill and has been producing some form of telecommunication equipment since the 1880s. The modern Nokia was born in 1967 and became a conglomerate involved in aluminum, rubber, forestry, power generation, television, cable producer and electronics.

In 1982, Nokia introduced both the first fully-digital local telephone exchange in Europe and the world’s first car phone for the Nordic Mobile Telephone analog standard. The breakthrough of GSM (global system for mobile communications) in the 1980s introduced more efficient use of radio frequencies and higher-quality sound. The first GSM call was made with a Nokia phone over the Nokia-built network of a Finnish operator called Radiolinja in 1991. It was around this time that Nokia made the strategic decision to make telecommunications and mobile its core business. Its other businesses were divested.

By 1998, Nokia was the world leader in mobile phones, a position it enjoyed for more than a decade. And the rest you know.

Today, Nokia is trying to re-invent itself again with a focus on connectivity (it bought Alcatel-Lucent in 2016) and digital health. As part of its settlement with Nokia over patents, Apple agreed to purchase more of its network products and services.

However, even though it’s still a small part of the company, I am most excited by its move into the fast-growing digital health market. According to Transparency Market Research, this market is forecast to grow at a compound annual growth rate of 13.4% between 2017 and 2025, while increasing in size to $536.6 billion by 2025.

Nokia is using its acquisition last year of the French start-up and connected devices-maker Withings to launch a series of consumer health products and a revamped app that would collate data to give users a broader view of their progress. Withings makes security cameras, smartwatches and baby monitors as well as connected scales, thermometers and blood pressure monitors.

The stock has risen 23% year-to-date, thanks to a slowdown in the deterioration of its core networking business. If the move into digital health is successful, expect more gains as the 152 year old Nokia re-invents itself again.

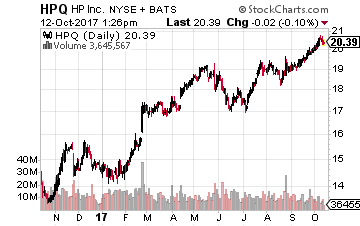

Zombie Stock #3 – HP Inc.

The third stock on my list is HP Inc. (NYSE: HPQ). When Meg Whitman split Hewlett-Packard into two companies in 2015, the Wall Street ‘wiseguys’ told everyone to jump into Hewlett Packard Enterprise (NYSE: HPE) and to dump stodgy old HP. All the ‘sexy’ parts were in HPE and all the old unwanted ‘old tech’ like PCs and printers were in HPQ.

The third stock on my list is HP Inc. (NYSE: HPQ). When Meg Whitman split Hewlett-Packard into two companies in 2015, the Wall Street ‘wiseguys’ told everyone to jump into Hewlett Packard Enterprise (NYSE: HPE) and to dump stodgy old HP. All the ‘sexy’ parts were in HPE and all the old unwanted ‘old tech’ like PCs and printers were in HPQ.

So naturally, year-to-date, HPE has collapsed by 36% while ‘zombie’ HPQ has soared by 38%.

While nearly everything has gone wrong for Meg Whitman at HPE (maybe breaking up is hard to do), dull HPQ is doing quite well. It has nearly $7 billion of cash on its balance sheet and it generated cash flow in the third quarter of $1.775 billion. It expects to return at least 50% of its cash flows to shareholders through buybacks and dividends. That’s my kind of zombie!

The remaining company’s 2016 revenues were split with 62% coming from PCs, notebooks, etc. and 38% coming from printers, scanners, etc. Despite the well-known decline of the PC industry, the company has regained the top spot in the sector and has enjoyed its fifth consecutive quarter of year-over-year shipment growth.

In the printer space, HP did make a big move to boost its business last year with its $1.05 billion acquisition of the printer business of Samsung Electronics, with its more than 6,500 patents. And it is now shipping its new A3 multi-function printers to more than 80 countries across the globe. This should add to the 6% gain in year-over-year printer revenues HP enjoyed in the third quarter.

And while HP still trails the leaders in the 3D printing field, it is making progress. Its Jet Fusion 3D Printing Solution should be a winner with the company’s focus on selling it to industrial markets (see my new Singularity report for how this all fits together). To that end, HP has collaborations in the 3D printing space with the likes of BMW, Nike and Autodesk.

There you go… with these ‘zombies’, you will be accumulating profits just as the Night of the Living Dead did. The low-budget $114,000 film grossed a total of $30 million in box office receipts globally.

Note: The author of this article is Tony Daltorio.

How to Collect $1,820 in Extra Monthly Income

I’ve just released updated details on a new system for collecting $1,820 in extra monthly income… for the rest of your life. It’s called the Monthly Dividend Paycheck Calendar because if you follow it you’ll collect dividend paychecks every month. And in certain months you can collect up to 6, 7, even 12 paychecks. You need to be enrolled in the next few days in order to make sure you’re on the list of the first payouts and don’t miss your first $1,820 in extra monthly income. Click here to start.

Category: Cheap Stocks