3 Top Monthly Dividend Stocks To Buy Before June

Take action today to increase your cash flow yield on your retirement portfolio by purchasing shares of any of these three high-yield dividend stocks. You can use their monthly dividends to help pay the bills or reinvest for your future. With monthly payments and high yields, there will be plenty of cash to go around!

Take action today to increase your cash flow yield on your retirement portfolio by purchasing shares of any of these three high-yield dividend stocks. You can use their monthly dividends to help pay the bills or reinvest for your future. With monthly payments and high yields, there will be plenty of cash to go around!

There are few things as useful for a stock market researcher as getting out and talking to a lot of investors. Last week I did two presentations at the Las Vegas MoneyShow and was a moderator on two Dividend Stock panels.

Through these events and having individual investors come talk to me, I learn a lot about what dividend-focused investors are concerned about. I also pick up the occasional stock idea.

One investor asked me about lodging/hotel REITs and a specific stock, which I will cover below. The lodging REITs own portfolios of hotels.

The typical REIT will specialize in a specific type, such as full-service hotels, select service hotels or extended stay. The REITs are the property owners. They sign contracts with management companies to market and manage the hotels.

The REITs collect the revenue and pay a portion as management fees. With rentals as short as one night, the hotel business is the commercial property sector that reacts the quickest to changes in economic conditions.

A hotel REIT strives to increase percentage room occupancy and the average daily room rate it charges. If those two metrics can be increased, profits will grow at a significant rate. Here are some of the pro and con factors about hotel/lodging REITs:

Pros

- Hotel results tend to mirror economic growth. If the economy is growing, so will profit for a hotel company. The current 2% GDP growth rate puts the sector in neutral for most of the hotel REITs. If economic growth were to increase, the returns from these REITs will be excellent.

- Since room rates can be changed on a daily basis, the hotel sector can react quickly to factors that increase expenses, such as rising interest rates. Hotel REITs generally have lower debt levels compared to other REIT sectors, but if interest rates do move up sharply, the hotel industry can respond by charging more.

Cons

- Hotel results tend to mirror economic growth. If the economy goes into a recession, hotel sector profits can disappear until the economy again starts to grow. In the current slow economic growth environment, hotel REITs have in general not increased dividend rates for the past several years.

- Hotel room rates can be threatened by over building of hotels, which has not been a factor in most markets during the current economic expansion. Hotels are also facing competition from technology-driven competitors such as AirBnB.

Here are two hotel REITs that are well managed, have conservative dividend payout ratios and pay monthly dividends. Current yields are very attractive.

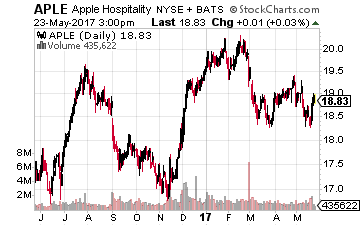

Apple Hospitality REIT Inc. (NYSE:APLE) is a hotel REIT that launched in the public market with a May 2015 IPO. The company was the roll-up of several private hotel REITs under the same manager. Apple Hospitality’s portfolio is exclusively branded as either Hilton (50%) or Marriott (50%).

Apple Hospitality REIT Inc. (NYSE:APLE) is a hotel REIT that launched in the public market with a May 2015 IPO. The company was the roll-up of several private hotel REITs under the same manager. Apple Hospitality’s portfolio is exclusively branded as either Hilton (50%) or Marriott (50%).

This is one of the largest hotel REITs, with 236 hotels in 33 states and a $4.2 billion market cap. The company has paid a 10 cent monthly dividend since the IPO. The current dividend rate is a conservative 68% of funds from operations –FFO– per share. APLE yields 6.4%.

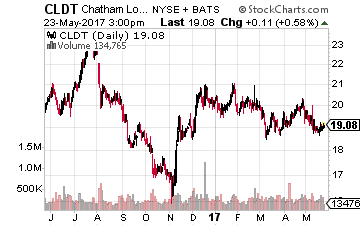

Chatham Lodging Trust (NYSE:CLDT) is a small-cap, $750 million market value, REIT that has been public since 2010. The company owns 38 hotels in 15 states. The portfolio consists of upscale extended stay and select service hotels.

Chatham Lodging Trust (NYSE:CLDT) is a small-cap, $750 million market value, REIT that has been public since 2010. The company owns 38 hotels in 15 states. The portfolio consists of upscale extended stay and select service hotels.

Chatham went to monthly dividend payments in 2013, and since then the dividend has grown from 7 cents per share to the current 11 cents. The rate was last increased in March of 2016. The current dividend is 62% of FFO per share. CLDT yields 7.0%.

Bonus Hotel REIT

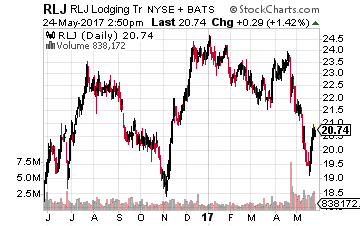

I n April, RLJ Lodging Trust (NYSE: RLJ) announced that it had agreed to buy FelCor Lodging Trust Inc. (NYSE: FCH) in an all-stock transaction that values FelCor at approximately $1.2 billion. RLJ is a $2.6 billion market cap REIT, so this acquisition will increase the size of RLJ by about one-third.

n April, RLJ Lodging Trust (NYSE: RLJ) announced that it had agreed to buy FelCor Lodging Trust Inc. (NYSE: FCH) in an all-stock transaction that values FelCor at approximately $1.2 billion. RLJ is a $2.6 billion market cap REIT, so this acquisition will increase the size of RLJ by about one-third.

Most importantly, this is an accretive transaction that should allow RLJ to significantly increase its quarterly dividend rate, which has been level for the last two years. The deal is expected to close in the second half of 2017. RLJ currently yields 6.3%.

Turning your retirement savings into a consistent stream of income is no easy task. You might spend hours researching what stocks to buy, only to end up more confused than when you started.

There are thousands of stocks to choose from, but only a small percentage of that group are the right stocks for you to own. The best high-yield stocks need to have safe long-term businesses that print money every year no matter what the market does. Those are the only companies that can pay consistent dividends.

That’s why I started my income letter, The Dividend Hunter, which uses my Monthly Dividend Paycheck Calendar tool to help investor start earning a reliable income stream from dividend paychecks.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 6 paychecks every month and in some months up to 14 paychecks from reliable high-yield stocks built to last a lifetime.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you can make from these low-risk, buy and hold stocks paying upwards of 12%, 13%, even 18%. I’ve done all the research and hard work, you just have to pick the stocks and how much you want to get paid.

The next critical date is Friday, May 26th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $2,001.70 in payouts by June 15th, but only if you’re on the list before May 26th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: Trading Penny Stocks