3 Small-Cap Stocks With 5%+ Dividend Yields

The Russell 2000 Index holds approximately 2,000 small-cap stocks. The Russell 2000 Index focuses on the smallest companies in the Russell 3000 Index, and therefore the Russell 2000 Index is viewed as a benchmark for small-cap stocks.

The Russell 2000 Index holds approximately 2,000 small-cap stocks. The Russell 2000 Index focuses on the smallest companies in the Russell 3000 Index, and therefore the Russell 2000 Index is viewed as a benchmark for small-cap stocks.

Small-cap stocks often do not pay dividends to shareholders, and if they do, usually have low dividend yields. Small companies need to reinvest as much cash flow as possible to fund their growth, which is why high dividend yields are hard to find among small-caps.

However, occasionally investors will come across a small-cap stock with a high dividend yield. The following 3 companies might be small, but they have big dividend payouts.

High-Yield Small Cap #1: Owens & Minor (OMI)

Owens & Minor has a market capitalization of just $1.06 billion, but the stock has a highly attractive dividend yield of 6.1%. The reason for Owens & Minor’s high dividend yield is its falling share price. The stock has lost approximately 40% in the past 12 months, due to eroding profit margins in its core business. Adding to the overall bearish sentiment is the threat of e-commerce giant Amazon (AMZN) entering the healthcare distribution industry, which in theory would only further depress prices. However, Owens & Minor still has a strong competitive position.

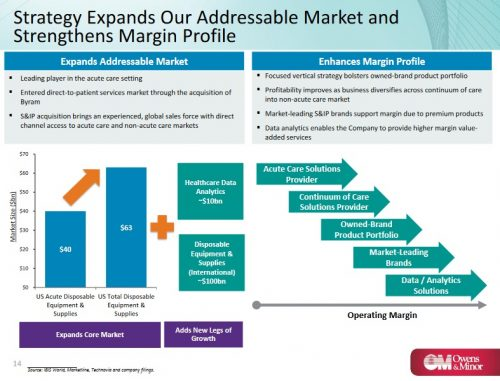

Source: Investor Presentation, page 14

Owens & Minor has been in business for over 130 years, and distributes approximately 220,000 different medical and surgical supplies to 4,400 hospital systems. Its durable competitive advantages allow it to remain consistently profitable, with the potential for a sustained turnaround.

In the most recent quarter, Owens & Minor’s adjusted earnings-per-share declined 26% from the same period a year ago. The company is investing heavily in strategic expansion, which will weigh on earnings in the near-term. It acquired Byram Healthcare, the second-largest operator in direct-to-patient home health. It also acquired the surgical and infection prevention business of Halyard Health (HYH) for $710 million. The S&IP business further broadens Owens & Minor’s product portfolio to include new medical supplies like sterilization wraps, surgical drapes and gowns, and medical exam gloves.

These investments position the company to return to growth in 2019 and beyond. Owens & Minor maintains a positive outlook for 2018, with expectations for accelerating growth thereafter.

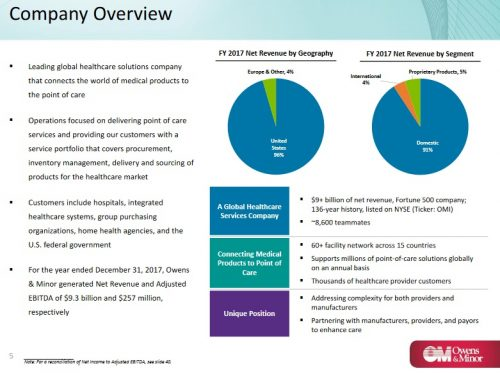

Source: Earnings Presentation, page 3

The U.S. healthcare industry still has strong fundamentals. The aging population and rising demand for healthcare are major catalysts for the healthcare industry more broadly, and for healthcare distributors specifically. Healthcare spending is expected to grow at a faster rate than U.S. GDP, and Owens & Minor is positioned well to capitalize.

Owens & Minor stated on its most recent quarterly earnings call that it expects earnings-per-share in the range of $1.40 to $1.50 for 2018. This sufficiently covers Owens & Minor’s annual dividend payout of $1.04, which indicates the dividend is secure.

High-Yield Small Cap #2: STAG Industrial (STAG)

STAG Industrial is a Real Estate Investment Trust, or REIT, which means it owns and leases real estate properties. STAG focuses on single-tenant, industrial real estate properties. It owns 370 properties in 37 U.S. states. It has a diversified portfolio, spread across multiple industry groups including automotive, air freight, industrial components, packaging, food & beverage, retail, and more.

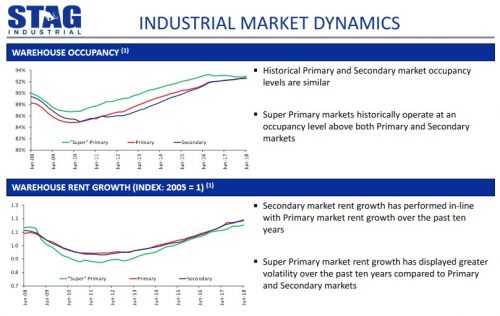

STAG focuses on industrial properties because the company believes single-tenant buildings are more prone to bigger pricing inefficiencies, which it can capitalize on through strategic investment. Plus, industrial real estate is a large and stable market.

Source: Investor Presentation, page 5

STAG’s portfolio strategy has led to steady growth over the past several years. More recently, the company reported strong growth through the first half of 2018. Adjusted EBITDA and funds from operation, or FFO, increased 16.9% and 19.2%, respectively, in the first six months. The company benefited from high occupancy, rent increases, and newly acquired properties.

Acquisitions are a major part of STAG’s growth strategy. In the most recent quarter, the company acquired 15 properties for $185 million. New property acquisitions provide additional cash flow and growth over time.

The most significant risk to STAG’s future growth is rising interest rates, which could make acquisitions costlier to finance. Fortunately, STAG has a manageable level of debt on the balance sheet. It has a net debt-to-EBITDA ratio of 4.7x, and an interest coverage ratio of 5.6x. It also has a credit rating of BBB, which should help contain interest expense in a rising-rate environment. This helps secure the company’s hefty dividend.

In addition to a 5% dividend yield, STAG offers investors an added bonus, which is that it pays its dividend each month rather than each quarter. The current monthly dividend payout is $0.118333 per share, or $1.42 per share on an annual basis. Since STAG generated $1.69 per share in FFO last year, and expects growth in 2018, the 5% dividend is covered with underlying cash flow.

High-Yield Small Cap #3: B&G Foods (BGS)

B&G Foods has a highly attractive dividend yield of 6.1%, which is a much higher yield than its larger competitors in the packaged foods industry. B&G Foods has a portfolio of over 50 food brands. Some of its core brands include Pirate’s Booty, Mrs. Dash, Ortega, Green Giant, Snackwell’s, and Cream of Wheat. The company generates annual sales of approximately $1.7 billion.

B&G’s growth strategy is to acquire food brands in smaller debt-financed deals, then scale those brands and raise prices over time to grow profitability. An example of this is the company’s recent acquisition of McCann’s Irish Oatmeal for $32 million. B&G saw great results from this strategy, particularly with low interest rates for the past several years. However, with interest rates on the rise, B&G’s hefty debt load is resulting in higher financing costs. B&G’s interest expense rose 25.5% last quarter, and increased 34% over the first half of 2018.

This is a key risk for B&G going forward. Fortunately, acquisitions have fueled B&G’s top-line growth. Last quarter, net sales of $388.4 million increased 7.4% from the same quarter a year ago, as the Back to Nature acquisition fueled 4.9% revenue growth. Higher pricing of 1.2% also contributed to positively to growth. Adjusted earnings-per-share declined 7.3% for the quarter, due to higher freight costs, as well as higher interest expense.

Investors should note that B&G has a hefty debt load. B&G ended last quarter with $2.07 billion in long-term debt on the balance sheet, compared with just $63 million in cash on hand. If interest rates spike over the next few years, B&G’s high dividend yield may not be sustainable.

One clear advantage for B&G is that the business model is recession-resistant. As a packaged foods manufacturer, B&G sees a certain level of demand each year, regardless of the economic climate. People will always have to eat, and during recessions, tend to reduce dining out. This means B&G could fare relatively well if another recession occurs over the next few years.

B&G has a high dividend yield of 6.1%, but the dividend payout ratio nears 90%. Combined with the high level of debt, B&G is a high-risk/high-reward dividend stock.

Note: This article was contributed to Modest Money by Sure Dividend. Sure Dividend helps investors build high-quality dividend growth portfolios using The 8 Rules of Dividend Investing. We look for businesses with strong, durable competitive advantages trading at fair or better prices.

Category: Small-Cap Stocks