3 Post-Selloff Bargains To Buy In Biotech

The biotech sector is offering valuations so cheap right now that in some cases you can buy shares in a company for less than the cash they have in the bank. Sentiment won’t stay this low forever, and when it turns these three stocks will rally back to their former highs.

The biotech sector is offering valuations so cheap right now that in some cases you can buy shares in a company for less than the cash they have in the bank. Sentiment won’t stay this low forever, and when it turns these three stocks will rally back to their former highs.

It has been an absolute brutal six months for biotech investors. The sector is in its deepest funk since the financial crisis and is now down some 35% to 40% from its previous peak in July. Small cap stocks have performed even worse with many down 50% to 75% simply on the shift of sentiment on the sector to “risk off” mode. Small cap stocks that sold for $10.00 a share in summer are going for $2.00 or $3.00 a share. However, the sector seems to be stabilizing over the past week and has rallied more than five percent off its recent lows. Large cap biotech stocks have held up well over the past month and, hopefully, that will still start to spread to smaller and mid-tier plays in the near future.

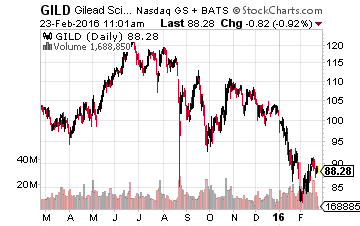

I have been slowly deploying “dry powder” into this sector on every dip in the overall market in 2016. Most of those new funds have been targeted at the big biotech names that are trading at their lowest valuations since 2011. No large biotech company is cheaper or less respected than Gilead Sciences (NASDAQ: GILD). This company has morphed into the Rodney Dangerfield of large cap growth stocks despite sextupling earnings from FY2013 to FY2015. The driver of that earnings growth is the runaway success of its two blockbuster hepatitis C drugs Sovaldi and Harvoni which did over $19 billion in sales in 2015.

I have been slowly deploying “dry powder” into this sector on every dip in the overall market in 2016. Most of those new funds have been targeted at the big biotech names that are trading at their lowest valuations since 2011. No large biotech company is cheaper or less respected than Gilead Sciences (NASDAQ: GILD). This company has morphed into the Rodney Dangerfield of large cap growth stocks despite sextupling earnings from FY2013 to FY2015. The driver of that earnings growth is the runaway success of its two blockbuster hepatitis C drugs Sovaldi and Harvoni which did over $19 billion in sales in 2015.

Despite this growth, the stock sells at just seven times earnings and provides a two percent dividend yield to boot. Harvoni was approved for two new indications of HCV just last week. The company should see growth for its HCV franchise in Europe and Japan this year even if the United States sees some minor declines as some of the sickest hepatitis C patients have now been treated. Investors are overly concerned about potential competition in the hepatitis C space and are giving Gilead no credit for its large and evolving pipeline.

In addition, the company is a free cash flow machine and should throw off some $15 billion in free cash flow this fiscal year. A partner at analyst firm Leerink Swann came out last week stating the company should generate $90 billion in free cash flow from FY2015 to FY2020. To put in perspective, Gilead’s market capitalization is just $125 billion. The company bought back 20% of its outstanding float over the last five years and should retire more than 10% in just this year alone. Basically, Gilead will continue to take itself “private” while the market refuses to recognize its value.

RELATED: The biotech icon with a $10 BILLION a year opportunity curing heart disease

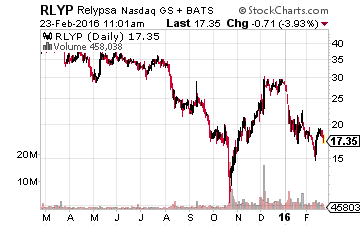

Next up is Relypsa (NASDAQ: RLYP). This small biopharma is selling for 40% less than it was when the FDA approved the company’s first commercialized drug “Veltassa” in late 2015. This is also the first new treatment for a condition called hyperkalima in several decades. This is a condition where there is too much of the electrolyte potassium in the blood and is usually found in individuals with other cardiovascular issues such as hypertension. The annual size of this market is estimated to be $2 billion annually.

Next up is Relypsa (NASDAQ: RLYP). This small biopharma is selling for 40% less than it was when the FDA approved the company’s first commercialized drug “Veltassa” in late 2015. This is also the first new treatment for a condition called hyperkalima in several decades. This is a condition where there is too much of the electrolyte potassium in the blood and is usually found in individuals with other cardiovascular issues such as hypertension. The annual size of this market is estimated to be $2 billion annually.

Relypsa’s main competitor in this space is a company called ZS Pharma (NASDAQ: ZSPH) whose product ZS-9 has a PDUFA date with the FDA on May 1st, although the agency might put off the approval date until late summer when more safety data is available. Veltassa has first mover advantage and I expect the companies to eventually split the market share in this lucrative space as each drug has its unique advantages.

ZS Pharma was bought out by AstraZeneca for a large premium in early November. The drug giant paid $2.7 billion to gain entry into the hyperkalima market. To put this in perspective, Relypsa has a current market value of around $775 million and the stock goes for just $18.00 a share. Its 52 week high is north of $40.00 a share. Relypsa has more than $250 million in cash on hand and is also potentially owed $100 million more in milestone payments not to mention a royalty stream that could be at least $200 million a year a few years out.

The company has been the subject of buyout speculation since Veltassa was approved. The only real question is what price will eventually be accepted by Relypsa. I believe the company wants $55.00 to $60.00 a share and suitors are trying to lowball with a bid of $40.00 to $45.00 a share given the horrid sentiment on this sector right now. At some point, I believe a deal will be reached somewhere in the middle of those ranges. Even as a standalone entity, Relypsa is deeply undervalued and the ten analysts that cover the company have a $45.00 a share median price target on RLYP.

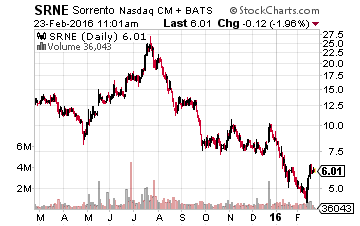

Finally, we have Sorrento Therapeutics (NASDAQ: SRNE). This oncology based developmental company came public in early 2014, and in 2015 was trading above $25.00 a share. It now trades for just over $6.00 a share although little has changed about the company’s longer-term prospects. Sorrento Therapeutics has a deep pipeline with multiple “shots on goal,” and approximately half of its market capitalization is represented by the cash on its balance sheet.

Finally, we have Sorrento Therapeutics (NASDAQ: SRNE). This oncology based developmental company came public in early 2014, and in 2015 was trading above $25.00 a share. It now trades for just over $6.00 a share although little has changed about the company’s longer-term prospects. Sorrento Therapeutics has a deep pipeline with multiple “shots on goal,” and approximately half of its market capitalization is represented by the cash on its balance sheet.

Dr. Patrick Soon-Shiong owns approximately 20% of the company and is on the Forbes 400 list after building and selling other biotech endeavors to larger entities, such as Celgene (NASDAQ: CELG), over the years. Insiders have continued to buy shares as the price has gone and many bought shares at much higher level than the current price of the stock. The median price target of the four analysts that cover Sorrento is $21.00 a share.

This is obviously a higher risk play than either Relypsa or Gilead given its pipeline is largely in mid-stage development. However, the company has great potential and a noted biotech billionaire who has a large stake in the firm. This stock is definitely worth a look as it offers a much more attractive entry price than just a few months ago.

When sentiment turns more positive on the biotech sector, which it inevitably will, these three stocks are poised to shoot much higher.

What we are seeing right now is nothing new. Bear markets happen, and the reality is great companies get sold off just as hard as all the others. My over two decades of experience successfully investing in this high risk/high reward sector has taught me what to look for, how to find, and when to buy those companies that can return life-changing sums of money to investors.

The three stocks that I detailed today have great potential, but there is one such opportunity right now that I cannot be more excited about and that I would like to share with you. It could be my most lucrative investment yet, and there is still time for you to join me. This company is revolutionizing how heart disease is treated and cured throughout the world, and in a few years could be flush with $10 BILLION a year in sales from this just approved drug.

An opportunity like this does not come around often, and all the signs are pointing to this being the kind of investment that could change your life. This isn’t some high-risk small cap investment either. This company has flourished throughout bear markets, recessions, and more for the last thirty years and is just now tapping into a goldmine that will propel its stock to new highs.

I invite you to click the link below to learn more about this once-in-a-lifetime investment opportunity.

Click here to learn more about this $10 BILLION opportunity.

Positions: Long CELG, GILD, and RLYP

Category: Biotech Stocks