3 Cheap Lithium Stocks To Buy That Will Energize Your Portfolio

Lithium is unquestionably a game changer, and these three Lithium stocks are a good way to join the party for cheap

Lithium is unquestionably a game changer, and these three Lithium stocks are a good way to join the party for cheap

Poor lithium. The metal is so light it floats, so soft it crumbles and so unstable it’s perpetually searching for a partner, which is exactly why we love it. Lithium has what scientists call a valance electron, a single negatively charged particle orbiting far from the nucleus, which binds easily with other atoms. This inclination to “share” itself is what makes lithium particularly effective at transmitting energy and conducting electricity.

It’s also one of the reasons why lithium is ideal for rechargeable batteries, since that flirtatious electron can return home just as quickly as it left.

Hard to Find

Lithium is unquestionably a game changer, and flirtation has blossomed into true love among engineers designing power plants for electric vehicles, handheld devices, even large scale power grids. There are some complications however.

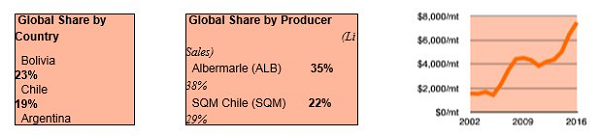

About two-thirds of proven reserves are concentrated in a small, high-elevation area of South America called the Golden Triangle, located at the intersection of Argentina, Bolivia, Chile. In addition, most lithium appears as tiny particles suspended in briny solutions that have to be pumped to the surface, and extracting lithium through evaporation can take months. Finally, just four companies account for 86% of global lithium production, compared to 739 publicly traded gold miners according to Bloomberg data.

Highly Concentrated & In-Demand

Lithium Overview

Perfect Storm

While lithium supply is highly concentrated, lithium demand is widespread and multiplying quickly. Two important new industries may ultimately swamp mobile device battery demand: Electric vehicles and utility power installations.

- Tesla Inc’s (NASDAQ:TSLA) Model S battery power plant requires more than 100 times the amount of lithium in a typical cellphone. Goldman Sachs estimates, “Every 1% increase in battery electric vehicle penetration increases lithium demand by around 70,000 tonnes of LCE/year.”

- Southern California Edison has just brought online 396 refrigerator-sized stacks of Tesla “Powerpack” batteries 40 miles east of Los Angeles. According to Moody’s Investors Services, “California is looking to the future, and in the long run, they would have less need — maybe no need — for new natural gas generation.”

Here’s your takeaway: Lithium stocks are about a lot more than cell phones. Lithium has a longer, steeper and wider glide path than forecast even two years ago. I like ground-floor businesses, and I especially like ground-floor stocks. With that in mind, here are three lithium stocks to buy under $3.

Cheap Lithium Stocks to Buy: Advantage Lithium COM NPV (AVLIF)

Advantage Lithium COM NPV (OTCMKTS:AVLIF) is not yet followed by the sell-side, but I suspect this could change and prove positive for the shares when initial drill results in the Cauchari region of Argentina are reported later this Spring.

AVLIF recently closed a $20 million CAD financing and share exchange with established producer Orocobre LTD NPV (OTCMKTS:OROCF) to develop this 85,000 hectare project. As CEO David Sidoo explained to me in an interview early February: “Advantage Lithium is in a unique position vs peers to provide lithium for production by 2019. Our aim is to build up resource size and confidence level through activities planned in 2017 (5 holes permitted to drill Q1), then move to preliminary feasibility studies by 2018 and fast track production by 2019-20.”

Additionally, the company plans to follow-up its successful test hole in Clayton Valley, NV with three prospective drilling holes. Clayton Valley is home to the only operating brine deposit in the U.S. and just several hours from Tesla’s new Gigafactory.

Cheap Lithium Stocks to Buy: Lithium Americas C COM NPV (LACDF)

Lithium Americas C COM NPV’s (OTCMKTS:LACDF) ability to close its $286 million CAD financing and secure off-take agreements in the same month speaks volumes about its ability to move forward as a viable producer.

Funds will help support two production build-outs at the proven Cauchari-Olaroz project (world’s third-largest lithium brine deposit), and each will be capable of processing 25,000 LCE annually. Phase I will begin in coming months.

Also important to note, LACDF has an off-take agreement with mining giant Sociedad Quimica y Minera de Chile (ADR) (NYSE:SQM), which means production can get to the market more readily. There’s one caveat: Lithium Americas may not begin to actually receive revenue until 2018 or 2019, but recent developments make the company significantly less risky. Like AVLIF, LACDF has exposure in Clayton Valley and will initiate a preliminary feasibility study this spring.

Cheap Lithium Stocks to Buy: Lithium X Energy C COM NPV (LIXXF)

With last year’s purchase of rights to explore 6,078 hectares in Clayton Valley, Lithium X Energy C COM NPV (OTCMKTS:LIXXF) becomes the single largest holder of rights in the only operating brine deposit in the U.S. Critically, its acreage surrounds the current deposit mined by the world’s No.1 lithium producer Albemarle Corporation (NYSE:ALB), and several holes are within 1,000 feet of existing ALB production.

LIXXF also has two on-going projects in Argentina. Just last week, it closed a 100% interest in a 33,846 hectare project with 11 mining claims across one of the region’s largest know salt lakes, and it’s currently performing resource estimate studies at nearby Sal de Los Angeles.

Perhaps most importantly, CEO Eduardo Morales previously ran Rockwood Lithium Latin America and was part of the team, which sold the company to Albemarle for $6.2 billion, now the largest lithium mining company in the world.

Note: This article originally appeared at investorplace.com. For more articles about stocks to buy, click here…

Adam Johnson is the author of this article. Adam is Founder and Author of Bullseye Brief, an investment newsletter that presents thematic and actionable ideas. As of this writing, he did not hold a position in any of the aforementioned securities.

Category: Penny Stocks to Watch