3 Biotech Stock Beneficiaries Of A Streamlined FDA

With lower approval wait times and decreased regulations on the horizon, long-term investing opportunities in the biotech sector haven’t looked this great in over two years. Take a look at these three stocks in particular as they will reap the most reward from a streamlined FDA.

With lower approval wait times and decreased regulations on the horizon, long-term investing opportunities in the biotech sector haven’t looked this great in over two years. Take a look at these three stocks in particular as they will reap the most reward from a streamlined FDA.

After an approximate gain of 10% in February, the main biotech indices added more than three percent in the first week of March. More importantly, they broke through upward resistance levels that have been in place since the very end of 2015 and where several previous rallies have broken down.

There are several drivers to this significant rise in the sector to start 2017. Obviously, the unexpected November election result has propelled the sector as it has the overall market on the prospect of higher future economic growth after more than seven years being stuck in the weakest post-war recovery recorded to date.

In addition, the hope for tax and regulatory reform sometime in 2017 has also buoyed the sector and other parts of the market. Increased M&A activity has also played a large role especially in the small and mid-cap parts of the industry on increasing buyout speculation. Finally, the administration has pledged to streamline the FDA, which would quicken the drug approval process and lower developmental costs – two good things for the industry.

There are several names in my portfolio that I like regardless of possible changes at the FDA but certainly would or will benefit from a more efficient regulatory agency.

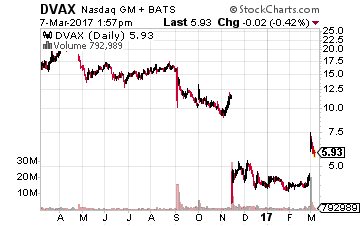

Dynavax Technologies (NASDAQ: DVAX) could be the poster child for the FDA’s inconsistency and intransigence in recent years. In 2013, the company submitted a Biologic License Application (BLA) for its hepatitis B vaccine “Heplisav-B” to the government agency. Despite clearly showing better protective traits and lower dosage regimen, the FDA said the several thousand-person study was not big enough.

Dynavax Technologies (NASDAQ: DVAX) could be the poster child for the FDA’s inconsistency and intransigence in recent years. In 2013, the company submitted a Biologic License Application (BLA) for its hepatitis B vaccine “Heplisav-B” to the government agency. Despite clearly showing better protective traits and lower dosage regimen, the FDA said the several thousand-person study was not big enough.

So, the company went back to the drawing board and put together a 14,000-person study that showed again clearly superior protective attributes (95% versus 81%) to the current standard on the market and can be administered in two doses over one month rather than three doses over six months. This should radically increase compliance rates which stand at a rather abysmal 55% with the current standard vaccine.

The FDA had not even checked through that data when it sent a complete response letter (CRL) to Dynavax for additional data on a cohort in the trial, again delaying action on Dynavax’s resubmitted BLA and cratering the stock late in 2016.

Last week, the stock soared as that response has been completed and Heplisav-B now has a PDUFA date of August 10th. I would look for the company to either raise some additional capital via a secondary offering or finding a funding partner.

However, with a market capitalization of under $250 million, the stock looks woefully underpriced. If approved, Heplisav-B should see peak annual sales north of $500 million. The company also has a promising oncology compound “SD-101” that just posted very encouraging early stage results and will have more trial visibility throughout 2017.

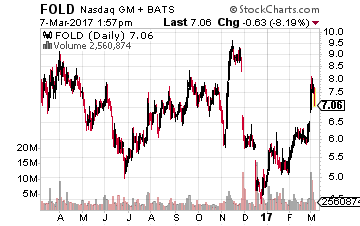

Amicus Therapeutics (NASDAQ: FOLD) is another name that has had a head scratching decision placed upon by the FDA in recent months. After its European counterpart approved the company’s primary drug candidate “galafold” in the second quarter of last year for Fabry Disease, the FDA punted, stating it will need additional trial results before it could approve the drug in the United States. This pushed approval here back to late 2019 or 2020 and will result in additional development costs.

Amicus Therapeutics (NASDAQ: FOLD) is another name that has had a head scratching decision placed upon by the FDA in recent months. After its European counterpart approved the company’s primary drug candidate “galafold” in the second quarter of last year for Fabry Disease, the FDA punted, stating it will need additional trial results before it could approve the drug in the United States. This pushed approval here back to late 2019 or 2020 and will result in additional development costs.

The stock surged last week on back of quarterly results that show significantly better galafold sales than expected (European approval gave the compound access to approximately 70% of the carriers of the disease).

The CEO also appeared on CNBC and the anchor speculated the company could be the beneficiary of positive changes at the FDA and maybe the recent decision around galafold could be revisited. In addition, the company has two other compounds in late stage trials for two other rare diseases.

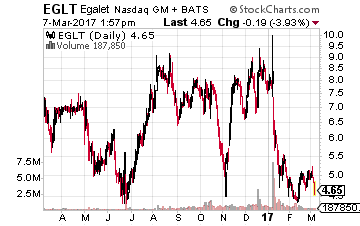

Egalet (NASDAQ: EGLT) is another name that was hurt early this year by the FDA decision to approve all three versions of a pain management candidate ARYMO ER but tagged only the IV version with the coveted label “Abuse Deterrent”. The drug’s Ad Comm Panel voted overwhelmingly to approve the drug and put the label on all three versions.

Egalet (NASDAQ: EGLT) is another name that was hurt early this year by the FDA decision to approve all three versions of a pain management candidate ARYMO ER but tagged only the IV version with the coveted label “Abuse Deterrent”. The drug’s Ad Comm Panel voted overwhelmingly to approve the drug and put the label on all three versions.

The FDA also gave exclusivity to the label in the intranasal category to a competitor until 2018. ARYMO should still be a viable drug and the stock’s sell-off seems overdone down to the under $5.00 level. Cantor Fitzgerald reiterated a Buy and $15.00 a share price target on EGLT soon after the decision and that is where the current median analyst price target also stands on the stock.

In addition to angry shareholders, lost sales or additional development costs when an adverse FDA action goes against a small cap concern, management usually needs to deal with nuisance lawsuits as the result of the stock price drop as well.

Unfortunately, there are three sure things in life. Death, taxes and if a small biotech stock drops more than 15% for any reason, some unscrupulous ambulance chasing law firm will initiate a class action lawsuit in the name of the “shareholder”. 95% of the time it turns out to be nothing but an immaterial nuisance.

I personally wish this country would initiate the United Kingdom “loser pays” rules in regards to this kind of litigation. 90% of these actions would cease overnight. Unfortunately, at any given time, 50% to 60% of congress is made up of lawyers; I don’t see that happening in my lifetime. However, if the administration is successful in reforming the FDA, hopefully biotech companies will face less of these challenges in coming years.

After having one of its best monthly performances in almost two years, the biotech sector looks like it will make a play from “worst to first” in 2017 by seeing a substantial rally across the board.

Right now the stocks in this lucrative sector trade for cheap prices on a historical basis, but I don’t see that happening for much longer.

With increased M&A and building momentum, now’s the best time in two years to buy in to biotech. If you’ve been sitting on the sidelines for a while now, I implore you to take a 60-day risk-free test drive of my biotech advisory service Biotech Gems.

This is where you’ll have access to my top biotech stock research and a portfolio of 20 stocks ready to be added to your portfolio right after joining.

These are the top stocks you can buy in this sector that all pass my stringent six-point criteria for finding and recommending consistent triple-digit winners in this space. With 60 days to try the service with no risk, why not try it out? Join today and receive your first “weekly update” that goes out every Monday.

Click here to start your trial.

Positions: Long DVAX, EGLT and FOLD

Category: Biotech Stocks