24 Simple Rules Of Personal Finance You Must Follow

Personal finance. Oh, personal finance. Why aren’t thou known to all?

Personal finance. Oh, personal finance. Why aren’t thou known to all?

That is the question, isn’t it? There really should be no reason that we have to cross the internet searching for the answers to personal finance because we can’t figure it out.

We should receive all the financial education we need on money matters in school and from our parents. However, the education system has failed us in this regard. They do not include basic money management in their education model. Certainly not investing basics.

It is on us to learn the good habits of personal finance by browsing the internet, talking with friends and family, reading books, attending seminars, etc. Eventually, we get a sense for how we are supposed to deal with our money.

So, we know that our education system fails us on personal finance, but why does it even matter?

Without some sense of personal finance and proper money management, we will likely flounder around and never be able to live the life we want.

The world runs on money. There is no way to get away from it. Because of this, we need to be able to manage our money so that we always have enough and are not lacking.

Most of us innately have bad money habits, and if we do not pay attention to it, we will let money fall by the wayside. The worst thing that can happen, is that we enter into the debt death spiral. It sucks us farther and farther in leaving us with a mess to clean up for years and years to come.

Personal finance is the organizational structure that helps us to manage our money, make more, spend less, and eventually allows us to claim financial freedom.

1. Don’t go into debt

Rule #1 is to never, never go into debt! Credit card debt is just about the worst thing we can do to ourselves.

Now don’t get me wrong, when I say never go into debt, I mean never go into bad debt. There are some debts that cannot be avoided, but the vast majority of debts can be avoided with careful planning.

Examples of good debt or acceptable debt:

- home mortgage

- business loan

- student loans

Examples of bad debts include:

- credit card debt

- a home equity line of credit

- payday loans

- high-interest rate debt

Notice I left off car loans from either list. I feel they are bad debt and that cars should be bought outright, however, the interest rates on loans for cars can be had at outrageously good rates these days.

Debt can suck is in. The more we have the easier it is to get more. So let’s do our future selves a favor and never go into bad debt to start with.

If we have entered into the debt death spiral, then we need to check out this guide on how to exit the death spiral.

2. Track your income and expenses

Without knowledge of where our money is coming from and going to how are we supposed to be organizing our finances?

Tracking our income and expenses is a great exercise for everyone. We must track everything down to the penny. No rounding, no shortcutting. Real honest tracking of all of our income and expenses. No expense is too small to be left off. That $1 soda every day adds up over the course of the month.

It may seem like nit-picking to say we have to track every penny. Pennies aren’t worth anything anymore. Hell, a dollar really isn’t worth much anymore. But that’s not the point. We are building habits.

With the habit of tracking every penny, we will begin to really understand our money habits and get a true picture of who we are. Without it, it is pure conjecture. We must have data (the income and expenses we are recording) to prove that we are on the right path. Without the data, we are not organizing our finances, we are just creating a fantasy.

Once again, using Personal Capital, we can track all of our expenses and income with no effort at all. All transactions that show up on our accounts are pulled into Personal Capital and aggregated. We just need to in and categorize them, so we can see where we are spending money. The only manual entries will be cash expenses, but who uses cash anymore? (Actually, I do because I live in China.)

3. Create a budget

After we have been tracking our income and expenses for a while, our budget naturally emerges. It is simply the sum of each category for the month or the year.

We can then look at each spending category and see if we can reduce it so that we can find more money that can be saved. The best way to budget is with the 0-based budget that includes savings as one of the categories.

0 = Income – Expenses – Savings

4. Follow your budget

Once we generated our first budget we can start to use it. However, keep in mind they are completely useless unless we keep them visible and follow the guidance that we set for ourselves.

No one else set the budget. We are in control. We just need to follow through with our commitment to ourselves. Following our budget will get us working harder and saving more quickly. This leads us towards financial freedom sooner where we will no longer have to worry about money. By that point though, money will be second nature and we won’t have to think about it anyways.

5. Spend Less Than You Earn

We saw the equation above to create a budget:

0 = Income – Expenses – Savings

or

Savings = Income – Expenses

I know, I know, we are not in school anymore. Why do we have to look at the math? But hold on with me.

What we see from the above equations is that income must be greater than expenses or it just doesn’t work. If our expenses are greater than our income than we must have negative savings. In other words, when we spend more than we make, we spend our savings down. If we have no savings, then we are spending money we don’t have by taking loans out.

Needless to say, we need to spend less than we earn. If we don’t we are basically stealing money from our future selves to spend today. Our future selves will hate us. Don’t let that happen!

6. Save more every month

Make it a goal to save more and more every month. It is a simple goal and one that can be achieved. Each month, we can focus on one spending category and work to decrease it. In turn, that will increase our savings. We need not take drastic action. It could be as simple as drinking a few fewer cups of coffee in the mornings.

Check out these awesome resources for ideas to save money.

7. Invest your savings

Now that we have savings to work with it is time to invest them. The simplest platform I have found for investing is M1 Finance. There is no simpler platform out there. M1 Finance makes it incredibly easy to get invested.

You choose the account type you want to invest in and then begin to contribute. You then select the pie that you want to invest in. Their pies are made from low-cost index ETFs. You can also choose individual stocks and ETFs and make your own pie.

Easy as pie (pun intended, couldn’t help myself :).

But really, get started investing today with M1 Finance, its FREE.

8. Don’t make emotional money decisions

Emotional money decisions usually suck. It is too easy to get emotional with money. The world runs on money to start with. The kicker though is that the media and ad companies play on our emotions to get us to make decisions that we would not otherwise make.

When we are emotional we are apt to make decisions that we will regret when we return to a normal state of mind.

The best example is when everyone is selling in the stock market and it is plummeting. The emotional decision is to sell as well to “cut your losses”. In actuality, you are locking in your losses. If you keep the stocks and just ride out the inevitable wave, then you will come out far ahead of where you were before the crash.

This happens over and over. 24-hour news agencies are to blame because they have to have something to talk about for all hours of the day. Just ignore it and when you recognize yourself as being emotional don’t play with your money.

9. Keep it simple stupid

As an engineer, I was taught the KISS principle in school. Keep it simple stupid. After school, working in a manufacturing plant, this really came to play out. The more complex a machine, the more modes of failure and the higher the possibility of failure.

This plays out in our finances too. If we construct highly convoluted ways to do things, they will eventually fail. We must strive to keep things simple. That is simply the surest path to financial success.

10. Max out your IRAs

Part of personal finance is preparing for your future. Keeping your future-self secure should be the main goal of yours as you progress through life. After all, none of us really want to work our entire life.

After we are done working we need to have a “nest egg” to draw upon and live on until it is our time to pass on.

One of the best ways to do this is to max out the tax-advantaged investing opportunities that the government affords us. In the US that is the Roth/Traditional IRA. We are all allowed to contribute $5500 per year to our IRA per person. So, if you are married you can contribute a total of $11000 per year with $1000/yr/person extra after age 50.

These accounts are held at pretty much all brokerage firms and allow you to hopefully to invest in whatever you want. Investing in simple index funds is the surest path to passive success.

Like above, I cannot recommend enough to open your IRA with M1 Finance for the simplicity it offers. Besides the simplicity it is free!

11. Max out your 401k

Like your IRA, if your employer offers a 401k, you should take advantage and max it out for retirement contributions each year. Now, the rules surrounding the 401k are different than the IRA.

They are cooperative plans with your employer, and your employer can limit the funds offered inside. Despite the limiting of funds and the addition of many overpriced actively-managed funds, you are usually able to find at least one that is a quality index fund.

The major advantage of the 401k is the opportunity for free money in the form of employer matching contributions. For each paycheck, you decide the percentage of money that is withheld and invested in the 401k. Most employers will then match some percentage of your pay also into the 401k to help motivate you to contribute to the investment plan.

For 2018, the max pre-tax/Roth contribution to a 401k is $18,500 with a total cap of contributions at $55,000!

This is a huge amount and may not be attainable for the average person. However, you should at least contribute the amount necessary to your 401k to get the full company match. If you do not, you are essentially giving away free money!

So get started with your 401k today.

12. If eligible, max out your HSA

The trend for health insurance in the US today is moving towards the high deductible health plan or HDHP. With HDHP, you are able to contribute to a special Health Savings Account or HSA. These accounts are pre-tax contributions and pre-tax withdrawals for medical expenses.

Being pre-tax contributions and withdrawals makes this the only account in the US that is totally exempt from taxes! I guess that makes outrageous healthcare cost in the US a benefit?!

Currently, the max contribution to a family plan HSA is $6,850 per year for the tax year 2018 or $3,450 for an individual.

The sum of investments for steps 10, 11, and 12 is $36,400. Most people can only dream of saving this much per year. If you can, then you are well on your way to becoming a financial ninja and attaining financial independence!

Keep up the good work.

13. Minimize your taxes

Every time you pay taxes, you are giving up some of your hard-earned wages.

Now, don’t get me wrong the government definitely provides some essential services like public schools, roads, and infrastructure. The amount of waste is exorbitant though, and we do not need to give so much of our wages to the government.

Enough about the government though, you are here to learn about personal finance.

In order to minimize your taxes, you need to take advantage of every tax deduction available to you. The best way to understand this is to study Form 1040. However, this is pretty boring, so I have done it for you.

In order to minimize taxes, you need to:

- Contribute the max to tax-advantaged investment accounts

- Claim children on your tax return

- Count business tax deductions if applicable

- Claim medical and dental expenses in excess of 7.5% of your income

- For all possible deduction consult the Form 1040 for the current year.

With the recent passing of Trump’s tax bill, the Tax Cuts and Jobs Act of 2017 (TCJA), our situation got significantly easier, though it didn’t remove nearly as many loopholes as promised. The standard deduction and personal deduction got significantly increased, to make it less necessary to itemize your return. This makes it much simpler, easier, and cheaper for us!

Take a look at your tax situation and you can save $1000s each year in taxes which is money in your pocket! You do not want a tax refund at the end of the year. A tax refund is a free loan to the government for the year. I think we can do better with our money!

14. Set Time Every Month to Review Yourself

We are tracking our income and expenses every month and investing wisely along with minimizing our taxes. That is a great start, but we can do better by reviewing our financial situation each month. It is during this review time that we can determine areas for improvement.

Maybe we spend too much on groceries and we need to apply some food hacks to reduce our grocery budget.

We may have also spent too much in general and need to look for more ways to save money.

Here are several resources to save and make more each month:

- 14 Stupid-Simple Grocery Store Hacks to Save Money on Food

- 10 Budget Hacks That Can Save You $1000s

- 50+ Ways To Earn Extra Money Today

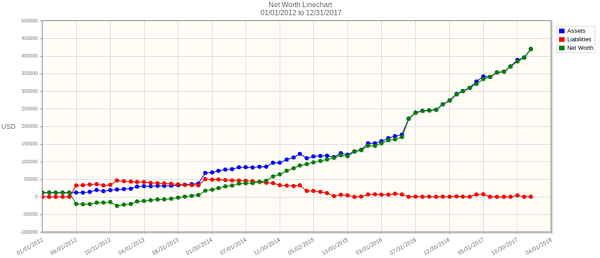

As a part of this review, we can plot our progress on a chart. This will help to visualize how we are doing. The numbers are great, but it is hard to really understand them until we visualize them against each other.

It is only when we visualize them that we are able to truly understand the trends. Are we getting better? Worse? Staying flat? In order to make progress, we must measure the metrics and plot our progress.

15. Know There is Always a Cheaper Way

Also, keep in mind that there is a cheaper way to do things. No matter how cheaply/frugally we are able to achieve something, there is a cheaper alternative available if we just look a little bit harder.

Now, the cheaper alternative is not always worth it as it may come with a quality cost. However, we should always evaluate the alternatives to at least see what we are giving up or getting by going cheaper.

This mentality above all else will drive us to save $1000s more each and every year.

16. Buy used when practical

Why do we buy things new?

Is it because we don’t trust used goods? Or is it because everybody else buys things new?

We can buy goods used and save 20-50+% on whatever it is. When you can have those savings there is very little reason to buy new. Most used goods are just as good as new anyways.

Buying used is one of the alternatives available when you are looking for the cheaper way. Are you giving something up?

Certainly, there is always the question of why the seller is getting rid of it, but most of the time it is because they simply don’t use it and are getting rid of it. So next time you buy a widget/gadget/whatever look at buying used.

17. Buy in bulk

There are certain items that you buy on a regular basis. There is just no way around the basic necessities of everyday life.

Things like:

- toilet paper

- batteries

- core ingredients for cooking

- Lots and lots more here

These things need to be bought on a regular basis, so when there is a sale on them, we should take the opportunity to buy in bulk.

If you can bundle the savings with more cashback from Ibotta, even better.

Buying in bulk doubles your savings. As the age-old saying goes:

Time is money.

So by saving time and money you doubly come out ahead.

18. Sell your old stuff

We all have too much stuff. Over the years it just seems to accumulate and we never seem to need all of it. Going through it is an excellent exercise in self-awareness and minimalism.

I challenge you to the following minimalist challenge:

Get rid of something every day.

This is a very simple challenge, just get rid of one thing. However, it is difficult for almost all of us to let go of our old possessions.

Putting a positive spin on it, we can sell them and recoup the cost. There is no better way to part with them.

You can sell your old possessions on eBay, Amazon FBA, or Craigslist among other outlets. You can even check for Facebook swap-meets or have a garage sale.

The possibilities are endless for selling your old goods. So get started today.

Pro tip: As you get rid of old stuff, don’t just replace it with new versions in their place. We all have too much stuff around.

19. Read a book or 2 on personal finance/money

There are 1000s of books out there on personal finance and money handling. The choice of a book can be overwhelming, and they might not even interest you.

Luckily, I have done the hard work and have narrowed down the list of personal finance books you should read to these 3:

- Your Money or Your Life

- The 4-Hour Work Week

- The Richest Man in Babylon

These 3 books provide the foundation for solid personal finance and will put you on the path to financial freedom. As always, though, keep coming back here for more on personal finance.

One bonus book for all you need to know on investing is the Boglehead’s Guide to Investing.

20. Buy everything on credit, it’s a free 30-day loan

This is a controversial recommendation on using credit cards. You must first be diligent and not go into credit card debt.

However, if you are diligent and pay your card off every month, then buying things on credit is a free 30-day loan. You get to keep your money for longer and have it work for you for longer. It all brings back more and more money to you.

The power of compound interest prevails.

Also, credit cards have many side benefits besides delaying payment day. They may:

- Have signup bonuses (ie free money!)

- Provide consumer protection

- Argue for you in disputed transactions

- Travel insurance

- etc.

Check out the Chase Sapphire Preferred Card as the best travel card out there. 50,000 bonus points after $3,000 minimum spend that can be transferred to multiple different airlines.

With all of these benefits, we should all take advantage. So long as we are smart and pay off our balance every month, then we will be better off because of credit cards.

21. Always pay your bills on time and in full

To go along with the previous rule of personal finance, you must always pay your bills on time.

Let’s put that in a big box.

Always pay your bills on time and in full.

There is no other way to put it. If you do not follow this rule, you will end up paying thousands in interest payments to others and may not be able to get loans for the big purchases that you need.

Being behind on your bills effects your credit score negatively which has far-reaching effects on your money life.

22. Buy online through eBates

In this day and age, the digital generation, we are all on the computer buying things. We buy our toys, our gadgets, even our groceries online.

When we do this we should be taking advantage of all possible ways to save. The best of which is eBates.

With eBates, you just sign up and it adds a browser extension to your web browser that makes sure you get money back at any applicable retailer.

You can also shop through their website and look for the sites that have the current best deals going on. If you are patient, more times than not, your favorite site will have a sale and extra cash back with eBates. Its a win-win for you.

The best part of it is, if you sign up with this link, you will get $10 extra cashback on your first purchase!

23. Start a Side Hustle

There are 2 ways to succeed with personal finance when looking at the finance equation:

Income – Expenses > 0

We can either decrease expenses or increase income.

There is no better way to increase income than to start a side hustle. Side hustles have become very popular recently as more and more people realize that their side hustle can create a freedom that lets us escape the rat race.

Check out this post for 50+ ways to earn extra money.

24. Check Your Credit Score and Report

Your credit score and credit report are pulled by any company that is taking a risk by loaning you money or services. I remember being quite surprised when the natural gas company pulled my credit report when I first got gas for my new apartment after college.

Taking the time to pull them and take a look is worth it.

You can get a great in-depth look at your credit score and credit report from Credit Sesame and Credit Karma.

However, the one truly free place to get your actual credit report from the 3 credit agencies is Annual Credit Report.

Conclusion

There are no secrets to financial success. There are just the simple steps outlined above that will bring us all to financial success. If we simply follow through on each, we can move towards a life where money is not a concern to us.

Note: This article originally appeared at Atypical Life.

Category: Personal Finance