10 Small-Caps Leading The Market Rebound

The less Donald Trump speaks about trade war, the more investors bid up stocks

The less Donald Trump speaks about trade war, the more investors bid up stocks

Stocks blitzed higher Monday, pushing the Dow Jones Industrial Average back up and over its 50-day moving average, as investors continue to respond to Friday’s “Goldilocks” payroll report.

Job gains came in stronger than expected. The unemployment rate rose, however, as workers reentered the workforce, and wage gains were tepid.

Also playing a role is the lack of trade escalation action between the United States and China following Friday’s imposition of new trade tariffs.

The tone of trade is a definitive “risk on” with equities rallying, Treasury bonds pulling back and overall market breadth strong. The action in small-cap stocks has been particularly impressive, with the Russell 2000 set to cap a five-day winning streak.

Here are 10 small-cap stocks leading the way higher:

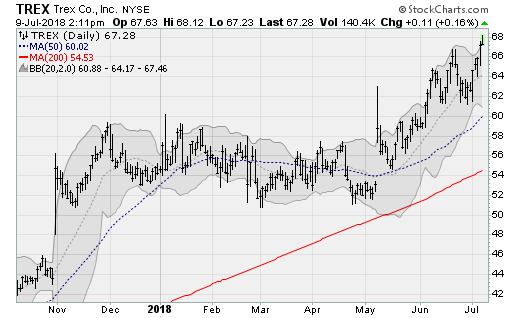

Small-Cap Stocks Leading the Rebound: Trex Company (TREX)

Shares of composite decking maker Tex Company (NYSE:TREX) are pushing to new highs breaking further out of the multi-month trading range near the mid-$50s that constrained action for much of the year. The company has benefitted from a strong housing market and remodeling demand.

The company will next report results on July 30 after the close. Analysts are looking for earnings of 65 cents per share on revenues of $190.8 million. When the company last reported on May 7, earnings of $1.25 per share beat estimates by six cents on an 18.2% rise in revenues.

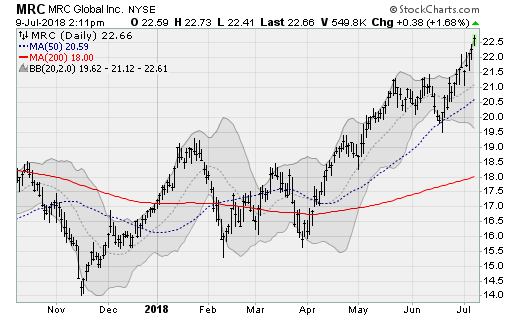

Small-Cap Stocks Leading the Rebound: MRC Global (MRC)

Shares of oil pipeline supplier MRC Global Inc (NYSE:MRC) — which makes pipes, valves and fittings among other products — have enjoyed a rally of some 50% from their early April lows. This thanks to the strength in crude oil prices and the energy infrastructure deficit, which has kept a lot of U.S. shale from going to market.

The company will next report results on Aug. 1 after the close. Analysts are looking for earnings of 21 cents per share on revenues of $1.1 billion. When the company last reported on May 2, earnings of 13 cents per share beat estimates by four cents on a 17.2% rise in revenues.

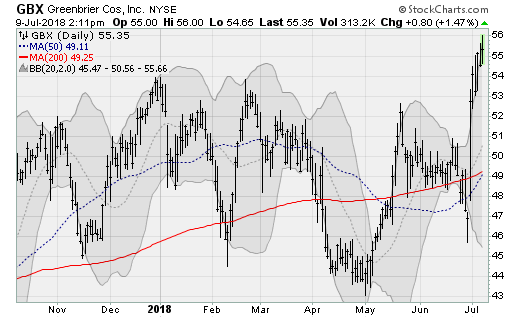

Small-Cap Stocks Leading the Rebound: The Greenbrier Companies (GBX)

Greenbrier Companies (NYSE:GBX) shares are breaking up and out of a long trading range going back to late 2016, returning to levels not seen since the summer of 2015, as the maker of railroad freight car equipment catches a bid.

Analysts at Stifel recently rated their price target on the company noting improvements in the rail equipment industry amid an aging asset base that will need to be replaced.

The company will next report results on Oct. 26 before the bell. Analysts are looking for earnings of $1.03 per share on revenues of $664.5 million. When the company last reported on June 29, earnings of $1.30 per share beat estimates by 15 cents on a 46% rise in revenues.

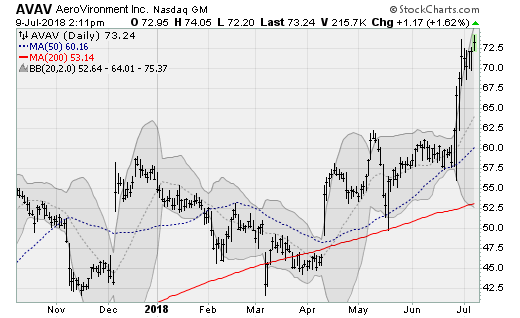

Small-Cap Stocks Leading the Rebound: AeroVironment (AVAV)

Shares of AeroVironment (NASDAQ:AVAV), maker of unmanned aircraft systems to the U.S. Department of Defense and others, is surging to new highs amid increased military spending from the Pentagon. The result is a tripling from the lows seen in early 2017.

The company will next report results on Sept. 4 after the close. Analysts are looking for earnings of 31 cents per share on revenues of $73.7 million. When the company last reported on June 26, earnings of 85 cents per share beat estimates by 33 cents on a 1.4% rise in revenues.

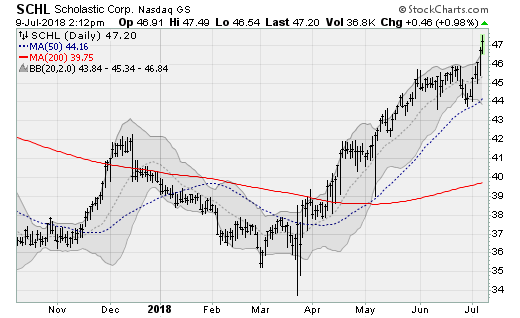

Small-Cap Stocks Leading the Rebound: Scholastic Corp. (SCHL)

Children’s bookmaker Scholastic Corp (NASDAQ:SCHL) is seeing its shares test prior highs from late 2016 in a gain of roughly a third from the lows seen back in March.

Revenue growth has been steady — as is the case for most child-related spending — with earnings impact juiced by the recent authorization of a $50 million share buyback program.

The company will next report results on July 19 after the close. Analysts are looking for earnings of $1.39 per share on revenues of $526.8 million. When the company last reported on March 21, a loss of 30 cents per share beat estimates by 74 cents on a 2.5% rise in revenues.

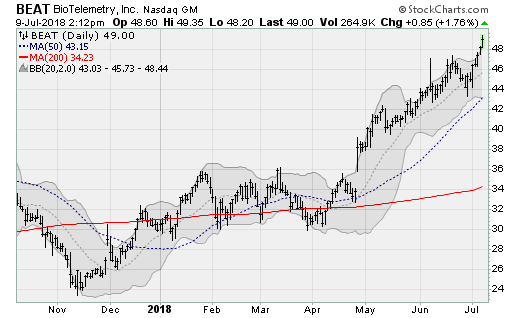

Small-Cap Stocks Leading the Rebound: BioTelemetry (BEAT)

BioTelemetry Inc (NASDAQ:BEAT) is a provider of mobile and wireless medical technology used to monitor heart and blood sugar levels among other uses.

The company recently launched its next-generation wireless blood glucose monitor with a touchscreen interface. Analysts at The Benchmark Company recently raised their price target to $46 on a solid medium-term outlook.

The company will next report results on Aug. 1 after the close. Analysts are looking for earnings of 30 cents per share on revenues of $95.9 million. When the company last reported on April 25, earnings of 39 cents per share beat estimates by 16 cents on a 69.1% rise in revenues.

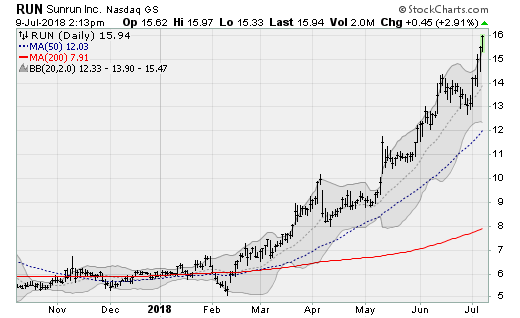

Small-Cap Stocks Leading the Rebound: Sunrun (RUN)

Sunrun (NASDAQ:RUN) is a designer, developer, and installer of residential solar energy systems. Shares have surged this year despite headwinds such as the imposition of tariffs on Chinese-made solar panels and flat demand as the company has been able to post revenue growth at three times the rate of the overall industry.

The company will next report results on Aug. 7 after the close. Analysts are looking for earnings of 29 cents per share on revenues of $167.7 million. When the company last reported on May 9, earnings of 25 cents per share beat estimate say four cents on a 37.4% rise in revenues.

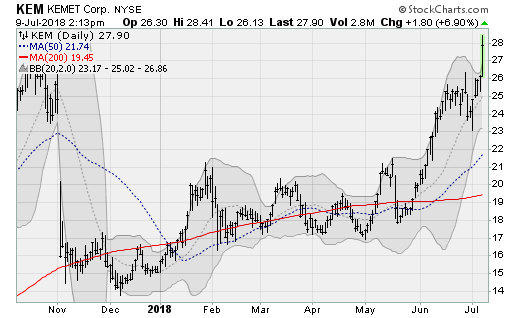

Small-Cap Stocks Leading the Rebound: Kemet (KEM)

Kemet Corporation (NYSE:KEM) shares are on a tear now, rising above their late 2017 highs to restart an epic uptrend that began in early 2016 and has seen shares gain nearly 30x.

The company is a making of passive electronic components markedly under the Kemet brand worldwide including sensors and actuators.

The company will next report results on Aug. 1 before the bell. Analysts are looking for earnings of 46 cents per share on revenues of $317.7 billion. When the company last reported on May 17, earnings of 45 cents per share beat estimates by four cents on a 61% rise in revenues.

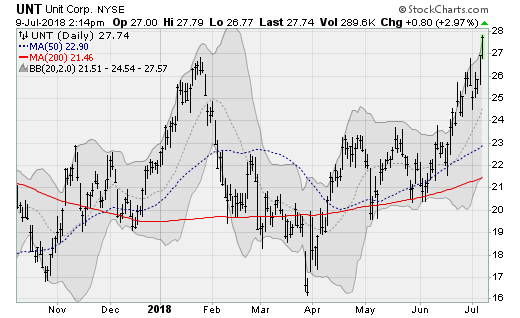

Small-Cap Stocks Leading the Rebound: Unit Corporation (UNT)

Unit Corporation (NYSE:UNT) is a contract oil and natural gas drilling company that’s benefitting from the recent strength in crude oil prices as a result of the reimposition of trade sanctions against Iran by the Trump Administration. U.S. shale activity is spinning up, as a result, benefiting oilfield services companies like UNT.

The company will next report results on Aug. 2 before the bell. Analysts are looking for earnings of 14 cents per share on revenues of $203.3 million. When the company last reported results on May 3, earnings of 21 cents per share matched estimates on a 16.7% rise in revenues.

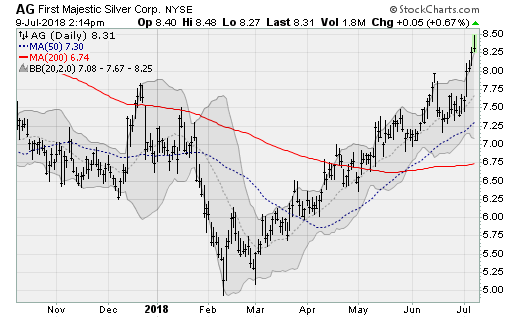

Small-Cap Stocks Leading the Rebound: First Majestic Silver (AG)

First Majestic Silver (NYSE:AG) is a silver mining company with a focus on properties in Mexico. Shares have been in a steady downtrend since the summer of 2016, resulting in a loss of some 75%, but look set for a sustained rise now with shares returning to levels not seen since early 2017, pushing above months of technical resistance.

The company will next report results on Aug. 13 after the close. Analysts are looking for earnings of three cents per share on revenues of $130.2 million.

When the company last reported on May 9, a loss of three cents per share missed estimates by a penny on revenues of $58.6 million, which missed estimates for $66.6 million.

Anthony Mirhaydari is the founder of the Edge (ETFs) and Edge Pro (Options) investment advisory newsletters.

See Also From InvestorPlace:

- 18 Stocks That Could Be Takeover Targets

- 10 Billion-Dollar Stocks for Q3 and Beyond

- 7 Stalwart Stocks That Benefit From Macro-Trends

Category: Small-Cap Stocks