Why You Should Consider Global Small Caps

Because the American equity markets have enjoyed an abnormally long period, – historically speaking, – of relative outperformance versus the rest of the global marketplace, a common plea among financial advisors and writers has been for investors to maintain discipline and continue to invest abroad. This, of course, makes sense; after all, a good portion of the outperformance of American shares can be attributed to strength in the dollar, something that is obviously not guaranteed to continue indefinitely.

Because the American equity markets have enjoyed an abnormally long period, – historically speaking, – of relative outperformance versus the rest of the global marketplace, a common plea among financial advisors and writers has been for investors to maintain discipline and continue to invest abroad. This, of course, makes sense; after all, a good portion of the outperformance of American shares can be attributed to strength in the dollar, something that is obviously not guaranteed to continue indefinitely.

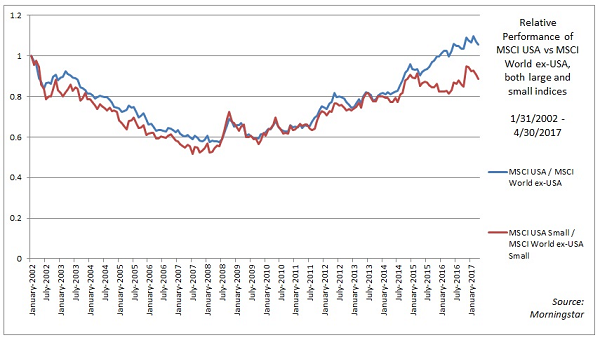

However, what is less discussed is that the relative outperformance of American shares has not spilled over into the small-cap space. As can be seen in the chart below, the last few years have seen American large cap shares regain the lead versus global large caps, while American small caps continue to lag global small caps [Note: The start date of 1/31/2002 was chosen as it is the earliest available start date for the MSCI World ex-USA Small Cap Index.]

There are many plausible explanations for this bifurcation in the performance of global large and small caps, among them that they are less vulnerable to dramatic swings in exchange rates as they are more domestically oriented in their operations, and also that global small caps tend to be far less concentrated in certain industries than large caps, thus making them more durable investments in the face of sector-specific headwinds. Lastly, regional small indices tend to have far less concentration in certain nations than large cap indices, thus reducing nation-specific political risk.

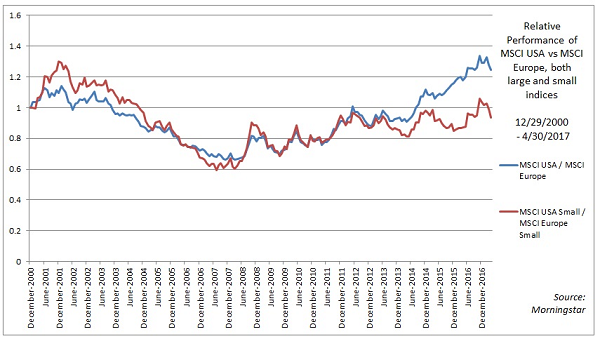

A good example of this is Europe. Going back to December of 2000 (the earliest common start point), European large caps have surrendered all the outperformance they once enjoyed, while European small caps have recently reclaimed the lead versus American small caps:

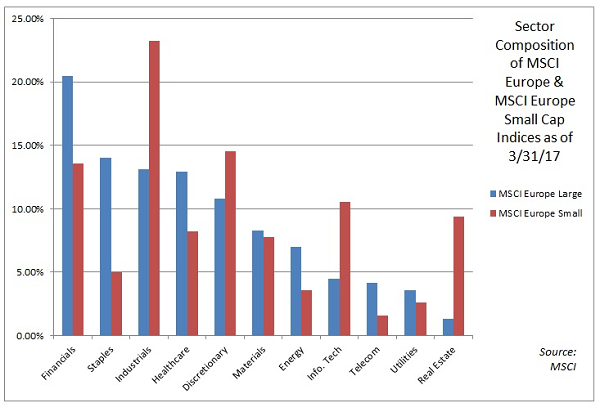

Looking at the difference in sector composition between the European large cap and small cap indices reveals that the large cap index has a heavy concentration in financials, which, since the global financial crisis, have dragged down the returns of the broader index, while the small cap index looks much more balanced across the spectrum, with more exposure to technology and consumer discretionary:

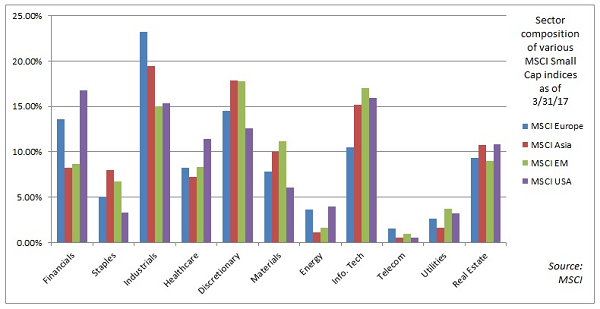

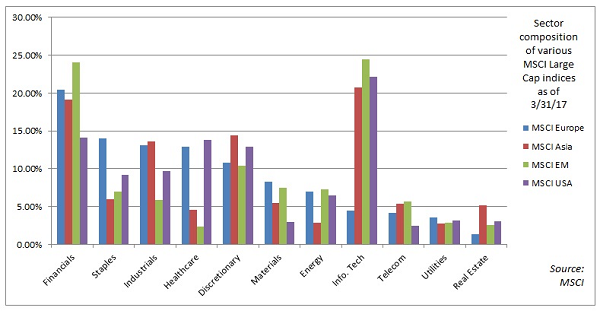

This greater balance among small cap names is generally true not just in Europe, but also in Asia and in emerging markets:

For comparison, here is the sector composition for the major large cap indices:

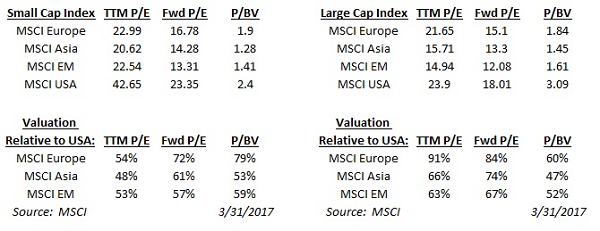

Furthermore, the discounted valuation that global small caps enjoy relative to American small caps is arguably more advantageous than the discount enjoyed by global large caps, at least on a price-to-earnings basis:

Global Small Caps

Luckily for interested investors, there are simple ways to implement foreign small caps into portfolios. ETFs that cover the space are offered by Vanguard and iShares, while other firms such as WisdomTree offer more targeted portfolios. This is important because being passive should not mean being complacent. Investing in foreign small caps gives investors more diversification both in terms of country and sector, and should be a part of every prudently allocated portfolio.

Full disclosure: Portfolios of Fortune Financial use funds and ETFs offered by Vanguard, iShares, and WisdomTree.

Note: This article was contributed to ValueWalk.com by Lawrence Hamtil. It first appeared on http://www.fortunefinancialadvisors.com/.

Category: Investing in Penny Stocks