Tech’s “Silent Partner” Poised To Outperform Apple, Facebook, and Google. Here’s Why

What a week for technology stocks.

What a week for technology stocks.

It’s not often you get powerhouses like Apple Inc. (Nasdaq: AAPL), Amazon.com Inc. (Nasdaq: AMZN), Alphabet Inc. (Nasdaq: GOOG), Microsoft Corp. (Nasdaq: MSFT), and Facebook Inc. (Nasdaq: FB) all reporting their quarterly earnings in the same week… but that’s exactly what’s happening this week.

Given that “technology stocks have been at the forefront of equity market gains and are pivotal for keeping the momentum going,” according to Rebecca O’Keeffe, head of investments at Interactive Investor, there’s little doubt that investors are paying closer attention than usual.

But here’s something that might surprise you…

Headlines Are Deceiving and Bigger Opportunities Are to Be Found Outside of the Big Names

In a note to their high-end clients, Goldman Sachs analysts Sharmin Mossavar-Rahmani and Brett Nelson say the role of the FAANG (Facebook, Apple, Amazon, Netflix, Google) and FAAMG (Facebook, Apple, Amazon, Microsoft, Google) stocks is actually overstated.

The headline figures:

- The S&P 500 notched a 21.8% return in 2017.

- The FAANG stocks rose by 46.5%.

- The FAAMG stocks climbed by 45%.

- The IT sector chalked up a 38.8% return.

Great stuff, for sure.

But the Goldman analysts note that if you strip out the last three groups – which boast respective market shares of 10.8%, 13.4% and 23.8% – “and reassign those weights back into the rest of the S&P 500, the returns for the S&P decline to 19.4% without the FAANGs, 18.9% without the FAAMGs, and 17.4% without the IT sector.”

Those are still impressive returns.

And since 2012, if you omit the FAANGs and FAAMGs, the S&P has notched an annualized return of 14.7% and 14.5%, respectively.

The point here? Don’t get sucked into the headline news and only look at tech’s biggest names. There are profits elsewhere, too. For example…

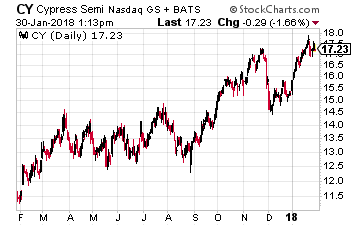

Cypress Semiconductor (Nasdaq: CY): Founded in 1982, the semiconductor stalwart designs, manufactures, and sells chips in a multitude of industries – including computing, mobile devices, auto, communications, networking, Internet of Things (IoT), and healthcare. We’re talking about systems-on-chips, touchscreen and fingerprint sensors, analog and wireless connectivity solutions, RAM and flash memory. The company operates in two segments – Microcontroller & Connectivity and Memory Products.

Cypress Semiconductor (Nasdaq: CY): Founded in 1982, the semiconductor stalwart designs, manufactures, and sells chips in a multitude of industries – including computing, mobile devices, auto, communications, networking, Internet of Things (IoT), and healthcare. We’re talking about systems-on-chips, touchscreen and fingerprint sensors, analog and wireless connectivity solutions, RAM and flash memory. The company operates in two segments – Microcontroller & Connectivity and Memory Products.

Cypress shares surged by 38% last year, as it capitalized on fast-growing semiconductor markets like the IoT, automotive (connected cars), industrial (factory automation), and consumer markets (connected homes), with the shift to increased connectivity continuing to gather pace. It also realized the impact of previous acquisitions like Broadcom’s connectivity business and auto electronics firm Spansion.

And there’s more to come…

M&A: At the recent Consumer Electronics Show, the consensus was clear: Expect more tech M&A activity this year. In the semiconductor industry, Cypress CEO Hassane El-Khoury forecast plenty more consolidation, following Intel’s $15 billion acquisition of Mobileye in late-2017, Marvell’s $6 billion purchase of Cavium, Broadcom’s attempt to take control of Qualcomm, and other deals for Cypress’ rivals.

Could Cypress be on the block, too? According to El-Khoury and CFO Thad Trent, it’s more likely that it will be buyers if the right opportunity arises: “Even though we were sitting on the sidelines [in 2017], we’ve been actively evaluating targets continuously,” Trent tells The Street. That being said, KeyBanc Capital Markets pegs Cypress as one of its top two takeover targets this year.

Connected Cars: Our cars aren’t just cars anymore. They’re mobile computers. The trend towards “infotainment” is gathering pace, with the market projected to double over the next five years.

Cypress is front and center of it. The chips it makes are crucial for car connectivity and IoT solutions. And with the amount of in-car electronics rising significantly, it’s a lucrative market.

At CES, Cypress announced two new products…

- A combination chip that offers in-car Wi-Fi and Bluetooth connectivity. The company says it’s the “highest performance Wi-Fi device in our IoT portfolio” – the only one with Real Simultaneous Dual Band technology that can transmit two signals, allowing multiple users to stream content to their devices concurrently. Production is underway and already in a couple of models.

- An in-car infotainment touchscreen controller that will ship in the next quarter.

Earnings: Cypress announces its fourth-quarter and full-year earnings today. It’s already beaten expectations in four straight quarters – including Q3 2016 revenue and EPS that jumped by 15% and 80%, respectively, as its IoT business surged.

The company also supplies the USB-C controller to Apple for the new iPhone, as well as 78 PC models (a number that will rise to 120 this year). Cypress’ already owns one-third of the USB-C market – with growth projected to catapult at almost 90% per year until 2021. Its third-quarter USB-C revenue doubled, ahead of the iPhone launch.

This time around, quarterly projections call for overall company revenue of $593 million and EPS of $0.25 – up 11.8% and 66% over Q4 2016, respectively. The company may well beat those estimates again, given that it already notched most of its quarterly revenue just one month into the quarter.

A Vital Engine Behind Tech Sector Growth

While big tech companies tend to grab most of the headlines, some of their businesses wouldn’t exist if it weren’t for “behind-the-scenes” firms like Cypress that make crucial components.

In Cypress’ case, its position as a leading chipmaker puts it on the leading edge of several huge, long-term tech trends like the IoT, connected cars and homes, Big Data, plus the ongoing ubiquity of mobile devices and network connectivity.

The future looks bright for Cypress – and its earnings today should underline that. With a PEG ratio of just 0.45, the stock is still considerably undervalued, too. The company also pays a $0.44 per share annual dividend – a 2.5% yield.

Note: This article was originally published on February 1, 2018.

The #1 Stock to Retire on (Over $1 million in income up for grabs)

Retiring well doesn’t have to be complicated. Forget “buy and hold” investments… forget options… forget Bitcoin…

One stock is all you need. And it’s not a blue chip stock like Wal-Mart. Over your entire retirement, you should see over $1 million hit your bank account thanks to this stock.

If you’re serious about a retirement with less financial worries, this #1 stock is your secret weapon. The first payout of the $1 million is days away.

Click here before you miss the window.

Category: Cheap Stocks