Six Small-Cap Points For 2017 And Beyond

Co-CIO Francis Gannon on what worked best in small-cap in 2017 and what investors should be looking at as we enter the post-tax-reform world.

4Q17 Gave Us More of the Same…

In 2017’s final quarter, the U.S. markets extended the performance pattern that characterized the first three quarters of the year: Small-cap growth beat value, large-cap beat small-cap, and international small-caps beat their US counterparts.

The Russell 2000 Value Index was up 2.1% in 4Q17 and 7.8% in 2017 versus respective gains of 4.6% and 22.2% for the Russell 2000 Growth Index. The Russell 2000 Index rose 3.3% in 4Q17 and 14.6% for the calendar year while the large-cap Russell 1000 Index gained 6.6% in 4Q17 and 21.7% in 2017. Finally, 2017’s best small-cap returns were posted by the Russell Global ex-U.S. Small Cap Index, which rose 7.1% in 4Q17 and 30.5% for the year, in both periods ahead of its domestic small-cap cousin.

The Russell 2000 Value Index was up 2.1% in 4Q17 and 7.8% in 2017 versus respective gains of 4.6% and 22.2% for the Russell 2000 Growth Index. The Russell 2000 Index rose 3.3% in 4Q17 and 14.6% for the calendar year while the large-cap Russell 1000 Index gained 6.6% in 4Q17 and 21.7% in 2017. Finally, 2017’s best small-cap returns were posted by the Russell Global ex-U.S. Small Cap Index, which rose 7.1% in 4Q17 and 30.5% for the year, in both periods ahead of its domestic small-cap cousin.

The strength of growth investing throughout the U.S. stock market was something of a surprise to us. Much of the relative strength for the Russell 2000 Growth Index came from its heavy weighting in 2017’s leading sector, Health Care, and a comparatively light weighting in the laggards of Financials, Real Estate, and Energy. After a surge of post-election optimism last year, banks were a notable disappointment this year as slowing loan growth and a flattening yield curve each took their toll.

…Except When It Came to Earnings

One striking—and in our view potentially very significant—reversal took place in 4Q17. Small-cap companies with earnings enjoyed higher returns than those without.

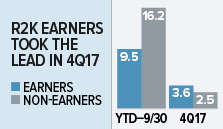

As often happens in a growth-led market, non-earners held a relative edge in the Russell 2000 through the first three quarters of 2017, when loss-making companies gained 16.2% compared to 9.5% for those with earnings. This shifted, however, in 4Q17, when gains for loss-makers in the small-cap index slowed to a 2.5% advance versus an increase of 3.6% for small-cap earners.

As often happens in a growth-led market, non-earners held a relative edge in the Russell 2000 through the first three quarters of 2017, when loss-making companies gained 16.2% compared to 9.5% for those with earnings. This shifted, however, in 4Q17, when gains for loss-makers in the small-cap index slowed to a 2.5% advance versus an increase of 3.6% for small-cap earners.

Why do we think this is so important? We expect investors to increasingly focus on individual company attributes, especially earnings, as well as company-specific risks. Indeed, Reuters reported in late November that while market volatility remains low, individual company volatility has been on the rise, with earnings news creating the most extreme movements up or down.

We think we could see a similar performance pattern in 2018, with leadership coming from small-caps that post stronger earnings growth. We have more to say later about where we think that’s most likely to occur.

Lower Your Expectations

As small-cap specialists, we’re always pleased to see positive returns for our asset class. However, we would offer a few words of caution about the road ahead for both small-cap stocks in general and small-cap growth stocks specifically.

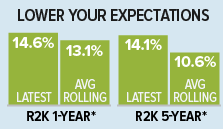

2017’s 14.6% return for the Russell 2000 was ahead of monthly rolling one-year average return of 13.1% since inception. Similarly, the small-cap index’s 14.1% five-year average annual total return for the period ended 12/31/17 ran notably higher than its 10.6% monthly rolling five-year average since inception.

2017’s 14.6% return for the Russell 2000 was ahead of monthly rolling one-year average return of 13.1% since inception. Similarly, the small-cap index’s 14.1% five-year average annual total return for the period ended 12/31/17 ran notably higher than its 10.6% monthly rolling five-year average since inception.

A similar comparison of small-cap growth’s recent returns versus its long-term history reveals an even wider gap. 2017’s 22.2% return for the Russell 2000 Growth Index considerably exceeded its monthly rolling one-year average return of 12.0% since inception, and its 15.2% five-year average annual total return for the period ended 12/31/17 was far ahead of its 8.6% monthly rolling five-year average since inception. We believe these higher-than-usual returns are simply not sustainable over the long run.

*Russell 2000 1- and 5-year returns as of 12/31/17 versus 1- and 5-year monthly rolling average returns as of 12/31/17.

Risky Russell

As bottom-up, fundamentally rooted investors in all of our strategies, we can’t help but notice that the small-cap index looks risky to us—like a stock not worth buying.

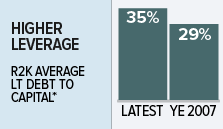

We see increased risk in the percentage of companies in the Russell 2000 with no earnings, more than 34% as of the end of 2017. The index in aggregate also has higher leverage than it did 10 years ago: the debt to capital ratio for the Russell 2000 was 35% at the end of 2017 compared with 29% at the end of 2007.

We see increased risk in the percentage of companies in the Russell 2000 with no earnings, more than 34% as of the end of 2017. The index in aggregate also has higher leverage than it did 10 years ago: the debt to capital ratio for the Russell 2000 was 35% at the end of 2017 compared with 29% at the end of 2007.

Additionally, it’s important to keep in mind that small-cap stocks have not seen a pullback greater than 6.4% for nearly two years, dating back to the last small-cap trough on 2/11/16.

So while we are confident in the prospects for select small-cap companies, we also remain firm believers in reversion to the mean. We think it makes sense to expect lower returns going forward for the small-cap index and urge even greater caution with regard to the prospects for small cap growth stocks.

*LT Debt to Capital is calculated by dividing a company’s long-term debt by its total capital.

The Opportunity Is Not With the Index, It’s With Select Companies In the Index

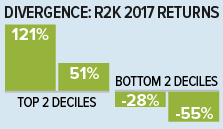

One attribute of the small-cap asset class that’s perennially underappreciated is its diversity. This point was exemplified in 2017 by the performance divergence for the top two deciles by returns, which were up 120.9% and 50.5%, respectively, versus the bottom two deciles, which fell 54.8% and 28.2%, respectively.

In our experience, regardless of how appealing or unappealing the small-cap index looks as a whole, we continuously find attractive investment opportunities in this vast universe.

In our experience, regardless of how appealing or unappealing the small-cap index looks as a whole, we continuously find attractive investment opportunities in this vast universe.

One factor that rewarded investors in 2017—and that we believe may continue to do so—was high profitability. Russell 2000 stocks in the top quintile of returns on invested capital gained 19.9%. Many of these stocks are in cyclical areas that we think are more attractive, including Industrials and Information Technology.

Why Global Growth Will Matter More Than The Tax Bill

Many investors are focused on the recent passage of the tax bill—quite understandably given the attention being lavished on it. And we share in the positive response to the reduced corporate rate, which should disproportionately benefit small-cap companies because on average they pay higher tax rates.

We suspect, however, that the excitement over tax reform means that investors may be missing what looks to us like a more significant development—the acceleration of the global economy.

We suspect, however, that the excitement over tax reform means that investors may be missing what looks to us like a more significant development—the acceleration of the global economy.

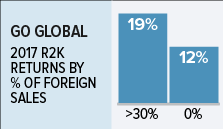

Its effects can already be seen by looking more closely at 2017’s returns for the Russell 2000 when those companies in the index with no foreign sales were up 12% while those with foreign sales of 30% or greater advanced 19% (ahead of the index’s 15% increase).

Another way to potentially take advantage of accelerating global growth is to consider international small-caps, which not only enjoyed a stellar 2017, but also have a history of rewarding selectivity. For example, within the Russell ex-U.S. Small Cap Index, companies with positive earnings have beaten the index as a whole, gaining 8.7% versus 6.8% on an average annual total return basis from 7/31/96-12/31/17.

Our Perspective: Stay Active

We expect small-cap performance to be driven by three factors: a preference for profitability, relatively lower valuations for both cyclicals and value stocks, and burgeoning economic strength both here and abroad.

Together, these support the leadership case for small-cap companies with global exposure in cyclical industries that also possess quality in the form of high returns on invested capital. These kinds of business look best-positioned to benefit from widespread growth—even in the event of a correction.

With selectivity and discipline being the keys, our advice remains, “Stay Active.”

Note: This article was contributed to ValueWalk.com by Francis Gannon, The Royce Funds.

Category: Small-Cap Stocks