Penny Stocks

What Is A Penny Stock?

When it comes to penny stocks, there seems to be a lot of confusion as to what they actually are.

Imagine people investing in something they cant even define!

So lets clear it up right now

According to the SEC, the official definition reads like this:

The term penny stock generally refers to low-priced (below $5), speculative securities of very small companies.

Thats not a bad definition, but youll notice they include the word generally. The reason for that is because their definition leaves out one important component- market capitalization.

Market capitalization or market cap for short, simply refers to the overall size of a company (its found by multiplying a companys outstanding shares by its stock price).

Based on this, you have three different types of penny stocks nano-cap, micro-cap and small-cap.

You don’t really need to know the difference (we lump all THREE into the same category), but here it is in case you’re wondering…

Nano-cap penny stocks have a market cap between $0 and $50 million. Micro-cap penny stocks have a market cap between $50 and $300 million. And small-cap penny stocks have a market cap between $300 million and $2 billion.

Again, we consider ALL of these penny stocks

As far as the actual price of the penny stock, you can really go all the way up to $10 a share as long as the market cap is under $2 billion. In most cases, all the benefits of investing in penny stocks apply to these stocks as well

So, to make this simple, were going to combine all this into one definition of a penny stock:

ANY STOCK TRADING FOR LESS THAN $10 A SHARE WITH A MARKET CAP BETWEEN $0 AND $2 BILLION

Thats a good, working, professional definition thats used by many professionals.

Where Are Penny Stock Traded?

Most people are surprised to learn that many penny stocks trade on the same exchanges as their larger brethren.

Occassionally you can find penny stocks that even trade on the New York Stock Exchange!

But due to listing requirements, most penny stocks trade on one of the exchanges listed below:

- NASDAQ Features quite a few penny stocks, especially technology, healthcare, and biotech stocks.

- AMEX Has a decent number of penny stocks listed but not as many as the NASDAQ

- OTCBB The bulk of lower priced penny stocks trade here. Many sub-$1 and sub-$0.01 stocks trade here.

- OTC Markets (formerly the Pink Sheets) This market is now divided into 3 tiers:

- The OTCQB is for companies registered with the SEC

- The OTCQX is for companies who arent registered with the SEC but do report their audited financials to the OTC Markets.

- The OTC Pink Markets is for companies who may or may not disclose any information to the public. These are the most speculative of the three tiers.

- Grey Markets These stocks arent listed on any exchange and trade through private transactions.

Where Do You Buy Penny Stocks?

Penny stocks, as weve defined them, can generally be purchased at nearly any brokerage firm, both online and off.

While every firm has their own rules and restrictions related to penny stocks, most allow the simple buying and selling of these shares without any additional paperwork.

If a brokerage firm has any additional restrictions on penny stocks, it probably has to do with trading them on margin or short selling them.

The best way to figure out if your brokerage firms allows the trading of penny stocks is to ask them. Every firm has slightly different rules so youll need to check into this for whatever firm youre considering or using.

Another important consideration when it comes to trading or investing in penny stocks is the commission youll pay when buying or selling.

This varies wildly from firm to firm so its important to check with your brokerage firm to see what they charge. The optimal mix is to find an inexpensive broker who also offers good execution.

What Benchmark Is Used For Penny Stocks?

When measuring the broad performance of any asset class, its useful to look at whatever benchmark most closely resembles the asset class is question.

For large cap stocks, the Dow Jones Industrial Average and S&P 500 are regularly used.

However, when tracking broad penny stock performance, its more useful to look at an index thats composed mainly of small cap stocks.

To that end, the Russell 2000 index and the S&P Small Cap 600 are wiser choices for penny stock investors.

Both of these indices are representative of smaller companies that tend to have market caps of less than $2 billion.

Why Do Investors Buy Penny Stocks?

Investors buy penny stocks are a number of different reasons but the opportunity to earn a very high rate of return surely sits at the top of the list.

The truth of the matter is penny stocks, as we’ve defined them, are still one of the most lucrative places invest money.

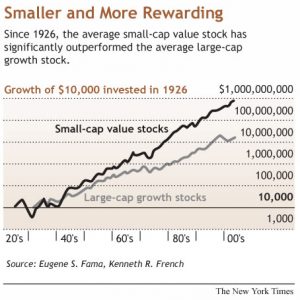

They say a picture’s worth a thousand words…

So take a look at this well-known chart published in the New York Times:

You can see that if youd put $10,000 into large, blue-chip stocks in 1926, youd have about $10 million today.

Thats not bad, but look at what would have happened had you stuck that same $10,000 into small-cap (penny) stocks…

Youd be sitting on nearly 1 BILLION DOLLARS!

While those numbers are calculated over an 85+ year time period, they do prove an important point

Penny stocks tend to outperform just about everything else over time including gold, real estate, CDs, treasuries, bonds and commodities.

Penny stocks offer a high rate of return but also carry a higher degree of risk as youll now see

What Are The Risks Of Investing In Penny Stocks?

Its a well-known fact that penny stocks can offer returns higher than many other forms of investments.

Of course, whenever you seek higher returns, you generally have to accept higher risk in return.

Its no different with penny stocks.

The types of risk investors assume with penny stocks generally fall under these three ares.

First, penny stocks represent companies that dont have a lot of good, reliable information available to investors.

The reporting requirements for many penny stocks are minimal to say the least. Depending on what exchange theyre listed on, some firms dont have to report anything!

Because of this lack of good information, its easier for these smaller companies to mislead investors about how theyre performing.

Second, penny stocks tend to trade a lower volume than larger stocks. Because they have low volume, the spreads you implicitly pay when buying and selling these stocks is higher.

The lower volume also means the volatility tends to be higher for penny stocks. So in general youll see their stock prices move up and down by larger percentages than larger stocks.

The low volume exhibited by penny stocks also leads directly to the last area of risk

Third, penny stocks tend to attract fraud.

Because of their low volume, penny stocks can be easily manipulated.

Whether its companies that dont really do anything to pump and dump operations run by scam artists, penny stocks are an ideal vehicle for dishonest people to rip off the public.

It goes without saying that when investing in penny stocks, its important to do your due diligence and get your information from unbiased sources.