Here’s How You Can Invest In Cryptocurrencies

Assuming you want to.. how can you get involved investing in cryptocurrencies?

Assuming you want to.. how can you get involved investing in cryptocurrencies?

In 2009, we witnessed the emergence of a first fully decentralized cryptocurrency called Bitcoin. Fast forward it to 2017 and people are investing in cryptocurrencies of over 900 types and 215 assets. In these eight years, the entire cryptocurrency market cap has gone from nothing to a whopping $145 billion.

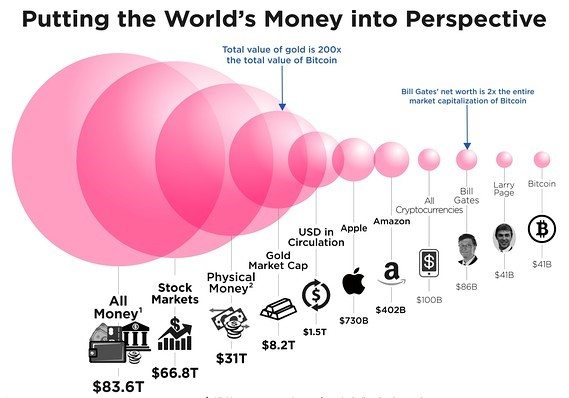

Needless to say, this market has made people millions of dollars who invested early. That being said, in grand scheme of things, the market cap will swell even more because as compared to all the world’s money, crypto market is tiny as illustrated by the following image.

It’s not too late to invest. Yes, of course, not all the 900 cryptocurrencies will survive over the years, but dozens will and their prices will skyrocket in the future. So if you play your cards right, you too could 50x your investment in a matter few years.

If you’re new to this crypto world, you must know that this market is highly volatile. Two years ago, Bitcoin price was hovering around $250 and now it is over $4000. Ethereum price started 2017 with $8 and reached its peak at $400 in less than six months.

The skeptics believe we are living in a crypto bubble which will eventually burst. There is a good chance you will lose all the money you invest in cryptocurrencies, but with the right strategies you can certainly minimize risk and loses. There is a famous saying in the crypto circle — “Invest the amount you’re willing to lose, because there is a good chance you will.”

The risk to reward ratio in this market is huge. That’s what attracts a lot of investors. Making profits out of short term trades is very difficult. Having a long term vision for your investments is key to make profits off cryptocurrencies.

If you’re prepared for a roller coaster ride, here’s how to go about it.

Investing in cryptocurrencies via Cash to Bitcoin method

You can buy bitcoin to use for investing in cryptocurrencies of other types, you will first need to purchase Bitcoin using fiat. The best way to do it is through a local exchange in your country. In the US, exchanges like Coinbase, Bitstamp and Kraken are go-to options for most people.

You can check exchanges in your country here. Although you can directly buy other coins from these exchanges directly, but the options are very limited.

If there is no bitcoin exchange in your country, you could always use localbitcoins.com and buy Bitcoin from other people. It is an escrow service which helps to match buyers and sellers. You can either pay the seller by cash or bank transfer. Most of the sellers advertise whichever payment method they prefer.

Note: You don’t have to buy one whole Bitcoin ($4112 at the time of writing); you can purchase Bitcoin in fractions known as Satoshis. 100k Satoshis is equal to 0.001 bitcoin. For instance, if you want to buy $500 worth of Bitcoin, you certainly can.

Now that you have some Bitcoin, you could either hold on to them or buy other cryptocurrencies with it. If latter is the case, transfer Bitcoin to one of the exchanges like Bittrex or Poloniex to buy other lesser known cryptocurrencies like Stratis, Monero, Siacoin etc.

If you’re planning on holding Bitcoin only, make sure to transfer them from the exchange to a Bitcoin wallet. This could be a hardware wallet, paper wallet or a wallet in your pc of which you control the private keys like Bitcoin Core client or Electrum.

Online exchange can be hacked and it is advised not to keep your crypto in any wallets you don’t control private keys of.

Investing in cryptocurrencies other than Bitcoin

Once you have Bitcoin in Bittrex or Poloniex, it is quite straight forward for investing in cryptocurrencies of your choice. Just like NASDAQ and the NYSE’s differing offerings of equities, not every exchange will offer every cryptocurrency.

Every exchange will ask you to go through a somewhat onerous process to verify your account. You’ll be asked for your id such as driver’s license or passport, and you’ll be verified within 1-3 business days.

After the account is approved, you’re all set to begin trading. Before buying any tokens do an extensive research on it and understand how it interacts with the market. This will help you predict trends.

Read the white paper and the roadmap of the project. It can be found on the official website of the cryptocurrency. Another important factor is to look at the real world use cases of that particular token you want to buy.

For instance, there is one token that’s supposed to be used for parking only. These types of coins have no real value and will die in the coming years. Look out for coins that can be used in real life and have a community behind it.

When you’ve identified your favorites and it a coin that you believe in you’re confident of the idea, tech and team – you’d want to hold on to that coin long-term because a good coin will always rise back up again.

If you’re doing short term trading, this is what you need to do — buy low, sell high. If the price of a coin you’ve bought goes up quickly, cash out into bitcoin and buy back again once the price goes down.

Keep track of your investments

There are a lot of apps that can help you track all your crypto investments. My personal favorite is Blockfolio, available for both android and iOS. It has major exchanges integrated to it and almost all the coins.

Keeping track of your purchases and sells will help you learn from your mistakes. Investing isn’t crypto isn’t a cake walk. You won’t be getting returns overnight. It is a long tedious process. Recording your past trades will only help you make better trades.

Lastly, greed can be extremely dangerous in trading. Whether you’re trading stocks or tokens, it holds true for both the cases. The more patient you are, the better you will do. Period. Especially for all your long holds.

Investing in cryptocurrencies – Takeaway

Investing in cryptocurrencies is very different from traditional trading. No one knows what will happen to the markets tomorrow.

Doesn’t matter how experienced of a trader you are, you will make some mistakes and lose money. Learn from those mistakes, get back up and make sure not to repeat them.

Also, doesn’t matter how much you believe in one crypto, the last thing you want to do is borrow money or take a loan to buy crypto. Don’t risk your life savings in this market. We are most likely living in a bubble which could burst at any time.

About the Author:

Anupam Varshney recently co-founded Bitcoinprice.com where they compare the price of Bitcoin with other assets like gold, silver and S&P 500. He has written extensively on Bitcoin situation in different countries like India, South Africa, Canada and more.

Note: This article was contributed to ValueWalk.com.

Category: Breaking News