How Could Small-Caps Surprise?

Co-CIO Francis Gannon discusses key topics for small-cap investors, including earnings strength, valuations, and the prospects for increased volatility.

Co-CIO Francis Gannon discusses key topics for small-cap investors, including earnings strength, valuations, and the prospects for increased volatility.

What is the current state of small-cap stocks?

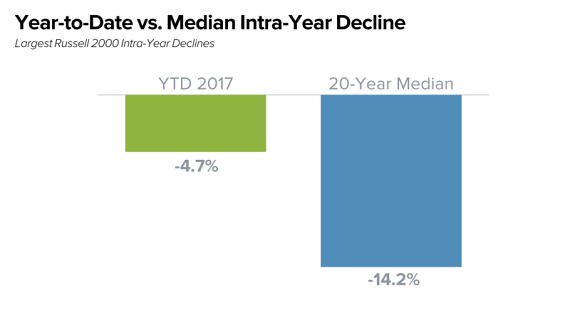

So it’s been a very interesting, I think, first half year in the small-cap market. We’ve seen various highs in the market. We’ve seen pullbacks in the market. The biggest pullback we’ve seen is just under five percent. We’re at a moment in time where I think we’re at a bit of a crossroads in the small-cap space. Either the market is going to break out of this consolidation, or have a correction. And you could argue either one. Historically, you would have seen at least a ten percent correction annually in the market. We haven’t seen that yet this year.

And the biggest surprise to me going forward is that you could see earnings actually do much better than people anticipate within the small-cap space. Part of this is driven by the fact that a year ago, people forget, we were just coming out of a profit recession. So we have very easy comparisons from an earnings perspective.

By the same token, you are seeing the beginning of a synchronized global economic pickup, which I think is going to really help the earnings in certain areas of the small-cap market. It might not help the overall market from a small-cap perspective, but you could see a pick-up in earnings power in many economically sensitive or cyclical businesses. That being said, could we have a correction? Yes, we could have a correction.

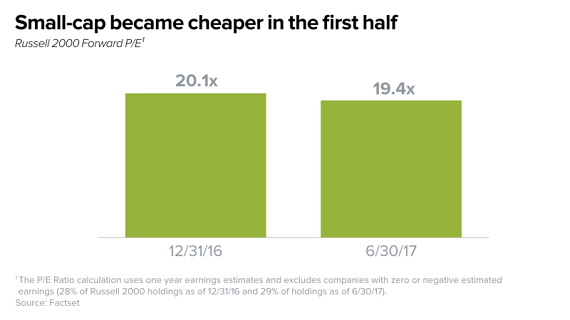

The surprising factor and I don’t think people really thought about this either, is the fact that small-caps, at the end of June 2017, are cheaper than where they were at the beginning, in January of 2017.

Earnings are much better and stronger than people realized. And so actually multiples have come down. Our job is not to focus on the valuation of the overall market. Our job is to focus on the valuations of our underlying businesses and the success and stability of those businesses.

But I think we’re going to see earnings continue to grow, or companies continue to grow into their multiples because of earnings, and therefore the market has the possibility of breaking out from here.

Why does higher volatility look likely?

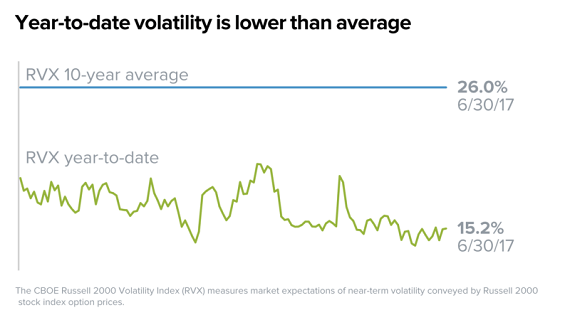

Volatility should pick up here. You know, part of what we’ve been talking about here for a very long period of time is this return to normalization, both from a fixed income standpoint or a rate perspective, but I think also you’re going to see it from a volatility perspective as well. We have had increased volatility around specific events over the past several years.

We had it around Brexit, we had it around the election in 2016. My sense is that you’re going to see an increase in volatility as the year goes on, which I think is healthy, especially as an active manager, we’re going to be able to find our spots in particular sectors of the market.

What do you think about the small-cap consolidation?

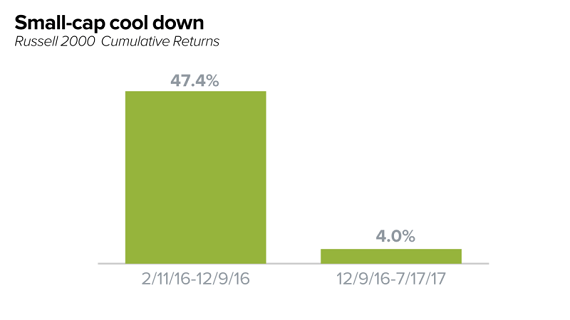

So the small-cap market has been in a consolidation phase, if you will, really since December of last year. And what I mean by that is we’ve had periodic highs in the market, but we’ve also seen the market pull back from those highs.

The biggest decline we’ve seen is about 4.7 percent. But we had new highs around April 1st of this year. We’ve had new highs in June, but the market sells off after we have these new highs. Now that being said, we’ve lived in a market where we’ve seen five consecutive quarters of the Russell 2000 being up, right?

The most recent quarter, the second quarter of this year, we were up two and a half percent. The first quarter of this year we were up two and a half percent. So we’re up about five percent for the year.

Why do I say we’re consolidating? I still believe that since December 9th of last year, through the end of the first quarter, the market really hasn’t done anything significant. And what you’re seeing at the beginning of the year was a rotating correction through a variety of different sectors.

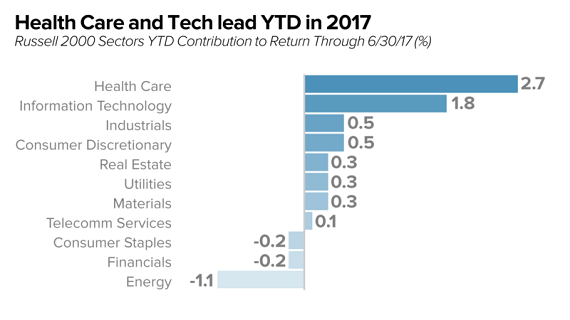

The year has been very much growth-led, where you’ve seen the growth year areas of the market, specifically technology and health care, led by biotech do better, along with some of the more defensive areas, as we’ve seen the yield curve come, come down a little bit and invert a little bit in the latter part of the first half of the year.

But what you’re seeing to me is a consolidation, which I think is quite healthy. There’ve always been two types of corrections in the market, when I think about them. Both price and time.

We’ve been in a time correction in the small-cap space, which I think is very healthy, and it’s one that I think is being missed by investors, who are looking for an opportunity to get into the small-cap space. We’ve traveled a lot around the country visiting investors this year, and I would tell you that many people are waiting for the big pullback and they’re missing it. They’re missing this consolidation which could possibly be the pullback in the overall market.

Note: Article by Francis Gannon, The Royce Funds. This article originally appeared at ValueWalk.com.

Category: Investing in Penny Stocks