Can Small-Caps Resume Their Rocket Ride?

Though the “Trump bump” helped, the year-old winning streak in smaller stocks owes far more to the spirited US economy. This rally has firepower, but we’d be choosy in riding the next leg higher.

Though the “Trump bump” helped, the year-old winning streak in smaller stocks owes far more to the spirited US economy. This rally has firepower, but we’d be choosy in riding the next leg higher.

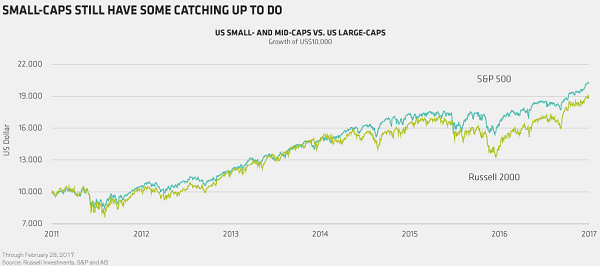

US small-caps have been on a tear for the past year. The small- and mid-cap Russell 2500 Index rocketed 17.6% in 2016, soundly beating the S&P 500 Index’s 12% gain. Yet, despite erasing several years of sluggish performance, small stocks still haven’t fully caught up with the large-cap index (Display). In the first quarter of 2017, the rally stalled, with the Russell 2500 up 3.8%, roughly two-thirds the gains of the broader market.

Small-Caps

As we see it, the US small-cap comeback is really a US recovery story. The expansion that began in 2009 continues to gain traction, with unemployment at historic lows and wage growth perking up. And, though policy details have yet to come, the Trump administration’s proposals to cut taxes and relax regulations have raised expectations for faster US growth. This backdrop should benefit smaller companies, which are more domestically oriented, pay higher taxes and face disproportionately stiffer regulatory burdens than do the larger firms.

Not a Blanket Call

Even so, while we remain positive on small stocks, we believe investors should be selective in how they get exposure. The macro environment and Trump’s policy proposals will affect different companies and industries in different ways. For example, rising rates are good for bank shares, but bad for interest-rate-sensitive REITs and utilities. New trade barriers may help US-centric firms that compete with foreign imports, but they could hurt small businesses that supply large multinationals facing higher import costs. And after the run-up of the past year, valuations matter. Today’s heightened geopolitical, monetary and policy uncertainties call for a hands-on, nimble strategy, in our view.

Opportunity in Neglected Cyclicals and High Growth

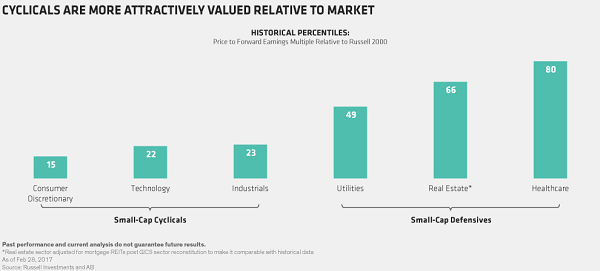

That’s not to say that attractive opportunities can’t be found. Small-cap market gains over the past five years have been heavily skewed to stable earners and high-dividend payers in healthcare, real estate, consumer staples and utilities. Cyclical and globally oriented technology, industrials and energy stocks have trailed. The hunt for income and safety also steered capital away from fastest-growth companies, which are more likely to reinvest profits back into their businesses.

As a result of these divergences, neglected small-cap cyclicals are trading at some of their lowest multiples relative to the index in nearly 30 years, while their defensive peers trade at some of their highest (Display). Relative valuations for high-quality, secular growth stories also look extremely attractive. With the economy on a strong footing, this valuation gap creates rich pickings for resourceful investors who take the time to find them.

A Hands-On Approach

In this environment, autopilot index-tracking approaches are at a big disadvantage, in our view. They can’t interpret the varying ways that new policies and economic developments may impact individual companies, nor can they avoid risky concentrations in overvalued pockets of the market.

It can be perilous to make broad judgments about how small companies will respond to specific policy proposals, which could look very different once they become law. And why settle for average if you can get better value and quality? That’s why we think the best course of action is to stay focused on company-specific earnings drivers, while maintaining flexibility to adjust to changing conditions on the ground.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Note: The article was contributed to ValueWalk.com by Bruce Aronow, James MacGregor, Shri Singhvi, Samantha S. Lau – Alliance Bernstein

Category: Investing in Penny Stocks