Zynga Named Best Idea For 2020

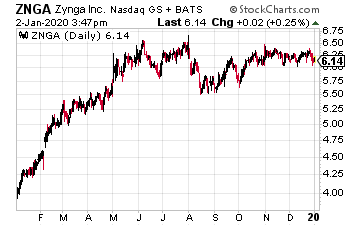

Over the last trading session, shares of Zynga Inc. (NASDAQ: ZNGA) closed at $6.12, a 0.3% decline over the previous session. As of today, the Farmville creator is up 66% from a low of $3.68 in January 2019. That’s more than double the 31% gain on the Consumer Discretionary Selector SPDR Fund (XLY), and the S&P 500 gain of 32% for the year to date.

Over the last trading session, shares of Zynga Inc. (NASDAQ: ZNGA) closed at $6.12, a 0.3% decline over the previous session. As of today, the Farmville creator is up 66% from a low of $3.68 in January 2019. That’s more than double the 31% gain on the Consumer Discretionary Selector SPDR Fund (XLY), and the S&P 500 gain of 32% for the year to date.

Zynga develops, markets, and operates social games as live services in the United States and internationally. The company’s games are played on mobile platforms, such as Apple iOS and Google’s Android operating systems, as well as on social networking sites, such as Facebook. It also provides advertising services comprising mobile and display ads, engagement ads and offers, and branded virtual items and sponsorships to advertising agencies and brokers; and licenses its own brands.

Wall Street firms have also rated the stock as a top pick. In fact, analysts at Stephens recently called this mobile gaming their “best idea,” noting they expect the company to bolster growth through further acquisition.

Zynga “is well-positioned for consolidation in the mobile gaming market,” they said, as quoted by Barron’s. “We believe the next six to 18 months will be a period of consolidation as established mobile players further leverage their core publishing infrastructure by acquiring sub-scale studios to drive growth. Zynga has a proven ability to successfully execute.”

In addition, analysts at Cowen just reiterated their $7 price target on ZNGA.

“We are naming Zynga as our Best Idea for 2020. Zynga has proven itself to be the most consistent company in the mobile gaming vertical over the last few years, delivering steady growth both through organic efforts and smart M&A. With an exciting 2020 product pipeline, valuation remains attractive against our (likely conservative) estimates for revenue growth; we reiterate our $7 price target,” notes Cowen, as quoted by CNBC.

Baird analysts list ZNGA as a top Internet pick for 2020 thanks to “visibility from live services, new title launches, potential for more M&A, and 2H improvement in EBITDA margins.”

Ian Cooper’s Personal Position in ZNGA: None

Note: This article originally appeared at Investors Alley on January 2, 2020.

Have you spotted the “5G” signal on your phone yet?

I’ve seen it pop up a few times in my travels. That tips me off that this technology is getting closer and closer to going nationwide. Once it does, it could transform how we do everything.

That’s why I immediately set out to find the number one 5G stock…

And I believe I found it.

Click here to see my #1 5G stock and to discover how 5G will affect you and your financial future.

Category: Cheap Stocks