Achieve Financial Success With 5 Personal Finance Habits

Developing ‘good habits’ has become an industry. From Charles Duhigg of The Power of Habit to Gretchen Rubin’s, Better Than Before: What I Learned About Making and Breaking Habits–to Sleep More, Quit Sugar, Procrastinate Less, and Generally Build a Happier Life, creating good habits is important across the spectrum or our lives. This article will show you how to be financially successful with a few simple habits. Simple financial success is not rocket science. Start early, start small and with practice you can become financially successful.

Financial Success Definition

Simple financial success is defined as the achievement of your personal finance goals. There’s a reason that they’re called “personal” finance goals, and that’s because they’re defined by you, not by society.

While one person might be thrilled to own a home, have $15,000 in the bank, and a good job, another might strive for financial independence at age 50.

Before you can take the steps to financial freedom, you must take a minute and figure out what is financial success, for you.

What Does Financial Success Mean for You?

Research shows that after you earn a certain amount of money, your happiness doesn’t increase much. So, realistically, you can have financial success without a boatload of money. In fact, financial success is more about these intangibles than it is a huge net worth:

Financial success means a secure tomorrow. Financial success means that you have enough money to cover your basic living expenses and a few extras for a satisfying life today and tomorrow. The dollar amount will vary based on where you live and your lifestyle.

After you craft your priorities and picture of financial success, then you can learn how to be financially successful. And, the steps to financial freedom are merely habits strung together over a period of time that will lead to your goal.

Financial success means that you have the basic necessities. This includes a home, transportation, food and some extras. Again, depending on your lifestyle, financial success doesn’t need to cost a log.

Financial success means that your have time to do what matters. No matter how much money you have, if you don’t have the time to enjoy life, then you can’t really enjoy financial success.

In order to craft your financial success with sound habits, you need to set your personal financial goals. Whether that includes buying a house or investing in real estate, writing down you goals, is the first step towards achieving them.

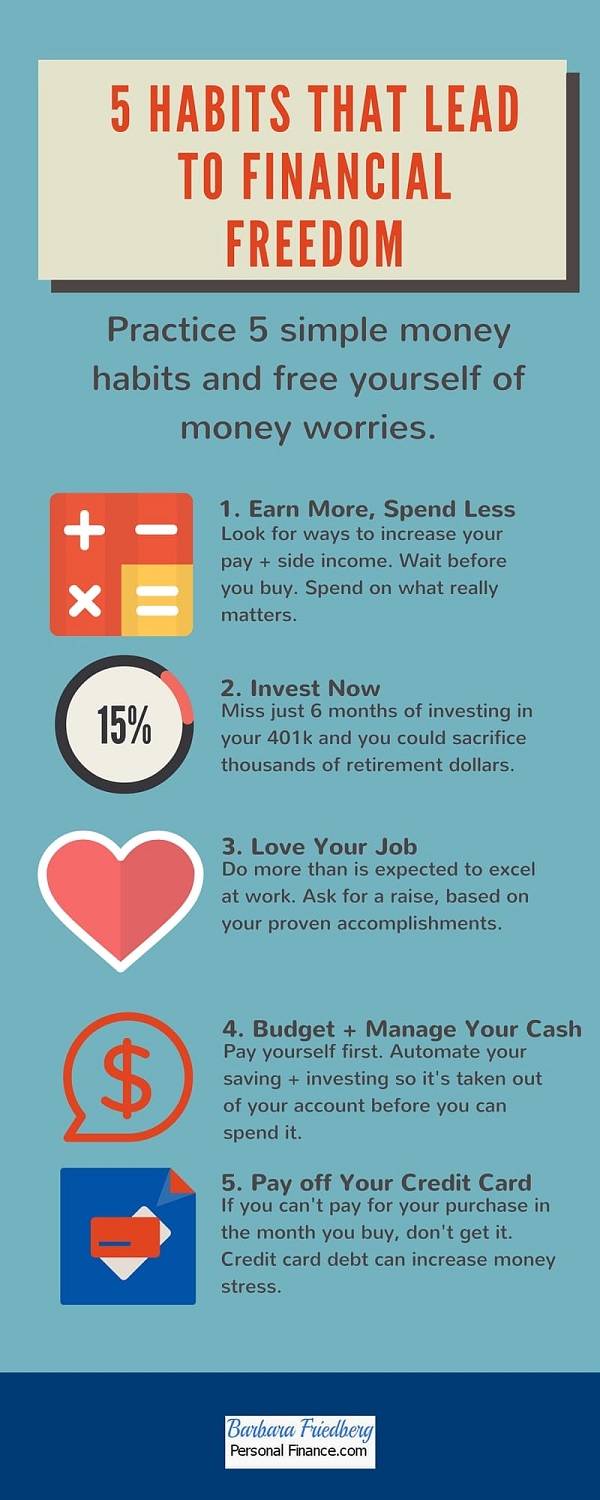

What are Financial Success Habits?

We don’t make our habits. Our habits make us. Getting rid of habits is a herculean task, or maybe it’s even more difficult because Hercules fought with external forces but the ‘habit fight’ is with yourself. Habits to help you achieve financial success and ultimately financial freedom are no more difficult than habits that lead you down the path of ruin. They’re simply a string of good money decisions added together and repeated.

If achieving financial freedom is your objective, then winning the fight is not an option. You must strangulate the bad habits, the ones that make you spend extra, and replace them with good habits to help you obtain financial freedom.

How to win the fight and achieve financial freedom and success?

My advice is to create and practice good financial habits. I know the good and bad binary is a reductionist idea. But I have tried this myself and it worked. It can work for you too. Below, are the good habits that can build your financial success and possibly lead to financial freedom.

1. Earn More, Spend Less

There should be a proportion. If you are making $4,000 a month, don’t spend more than $2,000. Your friends might call you stingy, but who cares. Many people whose life stories resemble the rags-to-riches-esque fairy tales said they got habituated with the penniless lifestyle and continued to live frugally even after becoming millionaires. You can find here tips to increase your income.

They were wise. They had the realization that there’s no relationship between earning more and spending more. Earning money is a result of financial success, which requires hard work and diligence. Spending extravagantly, on the other hand, shows a person with little control over his spending.

2. Don’t Wait to Invest

And let your hair become grey. Invest when you are young. You have an entire life ahead of you. Even if you fail, you can still get up and invest again. In the strong likelihood that you will succeed, you won’t have to look back.

Although, investment involves risk, not investing when you’re young is riskier. Losing those early years in which your money has the time to grow and compound is the riskiest path of all. The younger you are, the more time your money has to make up any early losses. Investors who’ve stayed in the market through ups and downs and not pulled their money out, haven’t lost investment dollars during any 20 year period.

As you age, you have families to look after and growing financial obligations. Getting started early gets you in the habit of putting yourself and your financial future first.

By starting earlier, you can invest less to build significant wealth.

3. Love Your Job

When passion and profession go hand in hand, attaining success becomes easy. Loving your job may not be easy for you but when you love doing what you are doing, you step onto the first stair of financial success. You take the work seriously, face no work pressure, and don’t complain about being neck-deep in work.

In short, you dedicate more time to your work. It may not lead to earning money instantaneously, but you develop skill and over the time, you become good at what you are doing. This leads to financial success. You don’t have to be an investment banker or a rocket scientist. Whatever you are doing, make sure you love doing it.

Why not create a money-making side hustle as well. Use that extra cash to make your financial success goals arrive faster.

4. Budget and Manage Money Right

Saving money is the prerequisite to financial success. True, a few lucky people realize overnight success, but the percentage of such people is so small that they need not be considered. An average person cannot be financially free if she doesn’t make a budget.

For the simplest budget, and my favorite is to automate your saving and investing. That means have your investing automatically transferred from your paycheck into your 401(k), investment account and/or IRA. Have a bit transferred into an emergency savings account.

Then, spend what’s left!

Or, you can keep track of income and spending and even use an investing and budgeting app to make things easier.

Budgeting is especially important when you are in your 30s and 40s. If you start stashing money away earlier, you’ll need fewer actual dollars to realize your retirement dreams. Unless there’s a system preventing the cash outflow, your financial situation can never be better. Budgeting is a part of money management.

To turn money management into a habit, track all your spending. Use your online resources to save money. When you make a budget, cover your needs first; saving, investing, rent, food and the necessities. Your wants and desires come last.

5. Avoid Borrowing Money

Sometimes, a debt is unavoidable. A student loan qualifies as the type of debt that may be necessary. In many cases, if you don’t take out a student loan, you won’t be able to continue your studies. But not all debts are like this. Credit card debts are almost always unnecessary. In fact, you can live debt free.

There’s a remedy that you can follow in order to stop credit card debt. The remedy is spending only 10% of the credit limit. If your credit limit is $5,000, don’t spend more than $500. Make this a habit. It might be difficult if you are a shopaholic, but with time, you’ll get accustomed to it.

And pay off your credit card bill in full every month! If you can’t afford to pay for something, then in most cases, you don’t really need it.

If you have an auto loan, pay it down as quickly as possible. If you haven’t started paying off your debts, now is the time to begin.

Practice these money habits to attain financial success. Although it’s not easy to start, the results will spur you on to greater money success.

Note: This article originally appeared at Barbara Friedberg Personal Finance. The author is Tina Roth.

Category: Personal Finance