Is This The Investment Opportunity Of The Decade?

Last Friday I spent the day at the San Francisco MoneyShow. I attend MoneyShows across the country as an invited speaker, giving presentations on income focused investing strategies. I also use these trips as an opportunity to talk one-on-one with some of the sharpest money managers and analysts in the investing world.

Last Friday I spent the day at the San Francisco MoneyShow. I attend MoneyShows across the country as an invited speaker, giving presentations on income focused investing strategies. I also use these trips as an opportunity to talk one-on-one with some of the sharpest money managers and analysts in the investing world.

A thought that came to me is that the long suffering energy midstream sector may have finally reached a bottom. If my prediction is correct, the sector offers a tremendous opportunity for high yield income and stock price gains for several years to come.

Energy midstream is the group of companies that provide transport, storage and processing services between the oil and gas production areas and the end users. These are the pipeline companies, most of which in the past were organized as master limited partnerships. The MLP/midstream sector has been in a five-year bear market. The Alerian MLP Infrastructure Index hit it’s record high at the end of August 2014.

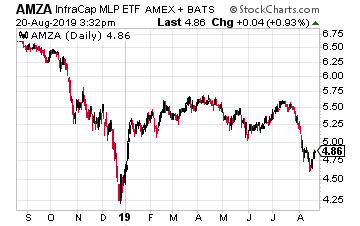

On Friday, I had lunch with Jay Hatfield, Founder and CEO of InfraCap Funds and the portfolio manager of the InfraCap MLP ETF (AMZA). This is a very high yield MLP fund. Jay uses some leverage and call option writing to boost the dividend paying ability of AMZA.

It is a recommended investment to my Dividend Hunter subscribers. Our lunch discussion focused on what is happening with individual companies in the energy midstream world. Jay has close contact with the management teams of many of the companies.

He shared his thoughts on what catalysts could turn around investor perception on stock values. The company’s themselves have spent the last three years restructuring their financials to be less dependent on outside capital for growth and to make dividends more secure. There are several possible merger and acquisition events on the near term (through end of the year) that could strongly increase the perceived value of midstream assets.

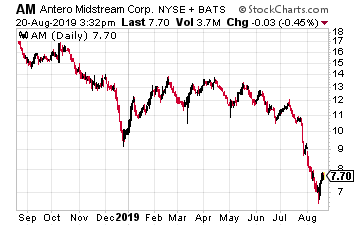

The trigger that pushed me to believe that last week may have been the blow-off bottom for midstream revolves around one stock. Antero Midstream Corp. (AM) is the current iteration of a very successful, high-growth MLP. AM is now a corporation, but the way the business operates is unchanged from when it was structured as a publicly traded partnership.

Antero Midstream has a strong history of solid dividend growth. From the MLP’s 2014 IPO, annual dividend growth was in the high 20% range with increases coming every quarter. Through most of that history, AM was priced to yield close to 4%.

Growth at Antero Midstream has slowed, but the company is still growing free cash flow at a mid-teens annual rate. However, with the recent crash of the share price AM now sports a 18% dividend yield. That’s a well-covered growing dividend from a quality midstream company.

The only description for that is stupid cheap. Earlier this week, I published an article (written before Friday last week) that lists a couple more midstream stocks that also show how tremendously undervalued stocks are in this sector.

For months, I have been looking for a catalyst that would turn around energy midstream stock values. Nothing the companies were doing seemed to influence share prices. It may be that the sector had to get so cheap, so undervalued that investors could no longer ignore the combination of great yields and growing businesses.

The #1 Stock to Retire on (Over $1 million in income up for grabs)

Retiring well doesn’t have to be complicated. Forget “buy and hold” investments… forget options… forget Bitcoin…

One stock is all you need. And it’s not a blue chip stock like Wal-Mart. Over your entire retirement, you should see over $1 million hit your bank account thanks to this stock.

If you’re serious about a retirement with less financial worries, this #1 stock is your secret weapon. The first payout of the $1 million is days away.

Click here before you miss the window.

Category: Cheap Stocks