8 Cheap Stocks That Are Leading the Blue Chips

Source: Shutterstock

These eight stocks are pushing the market higher ahead of the midterms

U.S. equities are rallying nicely on Monday, kicking off the week of the sure-to-be-contentious midterm elections on a positive note as President Donald Trump again pulls the “China trade deal hope” lever to bolster prices.

Today, Trump said Beijing wants to negotiate and that he could agree to a “fair deal” if offered.

While the tech-heavy Nasdaq Composite is still feeling the burn, largely on account of ongoing weakness in Apple (NASDAQ:AAPL) following weak iPhone unit performance, the Dow Jones Industrial Average is getting a lift thanks to a Chevron (NYSE:CVX) upgrade.

But the 30 components in the Dow aren’t the only large-cap stocks pushing higher. Here are eight other blue chips that are rebounding nicely:

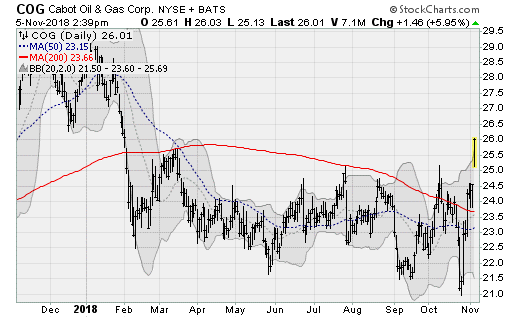

Cabot Oil & Gas (COG)

Shares of Cabot Oil & Gas (NYSE:COG) are surging higher here, breaking up and over their 200-day moving average to hit highs not seen since late January. Call option activity seems to be driving the price action as it comes just days after investors were disappointed by tepid quarterly results. The move pushes shares up and out of a long sideways consolidation range centered near the $23-a-share level.

The company will next report results on Feb. 22 before the bell. Analysts are looking for earnings of 41 cents per share on revenues of $564.4 million. When the company last reported on Oct. 26, earnings of 25 cents per share missed estimates by two cents on a 41.4% rise in revenues.

Under Armour (UAA)

Under Armour (NYSE:UAA) stock is moving aggressively higher, jumping over its 50-day and 200-day averages in late October on solid earnings and a series of analyst upgrades that followed. The result is a closing in on the prior highs set back in June. Analysts at the Telsey Advisory Group believes there is potential for the brand to grow faster as it recovers in the United States and expands internationally.

The company will next report on Feb. 12 before the bell. Analysts are looking for earnings of five cents per share on revenues of $1.4 billion. When the company last reported on Oct. 30, earnings of 25 cents per share beat estimates by 13 cents on a 2.4% rise in revenues.

Nokia (NOK)

Shares of Nokia (NYSE:NOK) are pushing back up to levels not seen since the summer thanks to an upgrade by analysts at Canaccord Genuity, who are looking for continued strength following a solid quarterly earnings result and a selection by a large utility to supply and install Smart Telecom Poles in India.

The company will next report results on Jan. 31 before the bell. Analysts are looking for earnings of 13 cents per share on revenues of $6.6 billion. When the company last reported on Oct. 25, earnings of six cents per share beat estimates by a penny on a 0.8% decline in revenues.

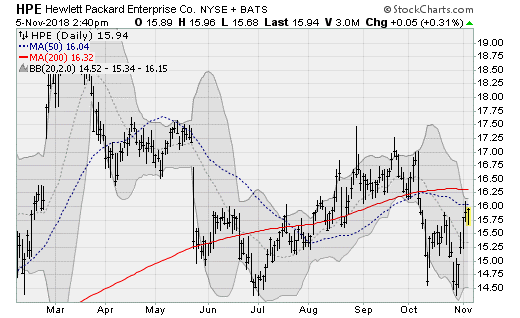

Hewlett Packard Enterprises (HPE)

Shares of Hewlett Packard Enterprise (NYSE:HPE) are bouncing off of their summertime low and closing back in on their 50-day and 200-day moving averages. the bounce looks technical but could have legs following an initiation of coverage by UBS analysts back in late September. Management recently issued solid forward guidance, looking for non-GAAP operating profit growth of upward of 8% per year.

The company will next report results on Nov. 27 after the close. Analysts are looking for earnings of 42 cents per share on revenues of $7.8 billion.

When the company last reported on Aug. 28, earnings of 44 cents per share beat estimates by seven cents on a 3.5% rise in revenues.

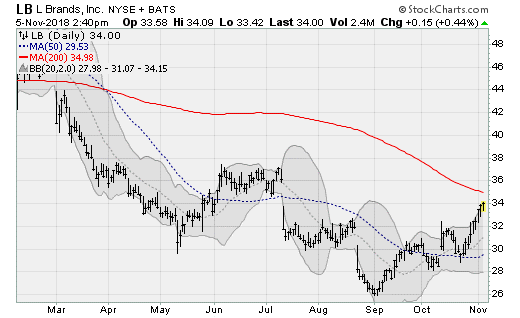

L Brands (LB)

Shares of L Brands (NYSE:LB), the company behind Victoria’s Secret and Bath and Body Works, is climbing back to challenge its 200-day moving average for the first time since February enjoying a rally of more than 30% off of its early September low. The stock recently enjoyed an initiation of coverage by analysts at Goldman, who are looking for a $36 price target.

The company will next report results on Nov. 19 after the close. Analysts are looking for earnings of four cents per share on revenues of $2.7 billion. When the company last reported on Aug. 22 earnings of 36 cents per share beat estimates by a penny on an 8.3% rise in revenues.

Nisource (NI)

Shares of Nisource (NYSE:NI) one of the largest regulated utilities in the United States, has popped up and over its 50-day moving average to close in on the highs last set in September. The rally comes despite some analyst headwinds, with Mizuho downgrading shares to neutral in October and Goldman removing the stock from its conviction buy list in September.

The company will next report results on Feb. 20 before the bell. Analysts are looking for earnings of 36 cents per share on revenues of $1.3 billion. When the company last reported on Nov. 1, earnings of 10 cents per share beat estimates by four cents on a total of nearly $965 million in revenues.

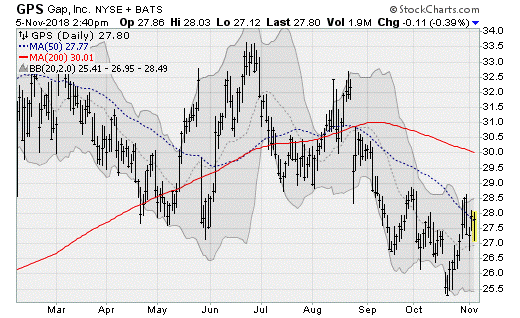

Gap (GPS)

Shares of troubled retailer Gap (NYSE:GPS) are scratching to climb back over its 50-day moving average after a nasty looking breakdown was suffered in October that took the stock below its springtime lows — breaking a level of support that can be traced back to October 2017.

Merely a return to the August reaction high, spurred by the start of the holiday shopping season, would be worth a gain of roughly 17% from here.

The company will next report results on Nov. 20 after the close. Analysts are looking for earnings of 68 cents per share on revenues of $4 billion. When the company last reported on Aug. 23, earnings of 76 cents per share beat estimates by four cents on a 7.5% rise in revenues.

H&R Block (HRB)

With tax season just around the corner (always waiting to greet overspent shoppers come January) shares of H&R Block (NYSE:HRB) are emerging from a four-month consolidation range to return to the highs not seen since early June. The changes to the tax code passed by President Trump and Congressional Republicans will come into effect for the first time in the 2018 tax year, adding additional complexity to those trying to self-file. Better pay up for help.

The company will next report results on Dec. 4 after the close. Analysts are looking for a loss of 93 cents per share on revenues of $139.8 million. When the company last reported on Aug. 28, a loss of 72 cents per share beat estimates by five cents on a 5.1% rise in revenues.

See Also From InvestorPlace:

- 7 Crude Oil ETFs to Consider on the Dip

- 7 ETFs for the Investing Opportunities of Tomorrow

- 7 Straight-A Stocks to Build a Portfolio Around

Category: Cheap Stocks