5 Stocks You’ve Never Heard Of Growing Double-Digits

Put some rapid growth into your portfolio with any of the five little-known stocks Bret Jensen recommends buying today. In today’s market, many popular stocks experiencing double-digit growth have been bid up to sky-high valuations but all five of these stocks are considered “Growth at a Reasonable Price.”

Put some rapid growth into your portfolio with any of the five little-known stocks Bret Jensen recommends buying today. In today’s market, many popular stocks experiencing double-digit growth have been bid up to sky-high valuations but all five of these stocks are considered “Growth at a Reasonable Price.”

It looks like profit growth within the S&P 500 will be flat this quarter on a year-over-year basis. Which, amazingly, is good news after five straight quarters of earnings declining in the S&P. The main market indices have held up remarkedly well with a big assist from the Federal Reserve during this extended “profit recession”.

The market has been weak over the past month as an ugly election season comes to an unseemly close. The S&P is down nearly three percent in the last month or so. Ironically, small caps have posted much deeper declines recently even as these names have less exposure to a strong dollar or a tepid world economy. It is also where the majority of growth seems to be coming from. In today’s column, we look at several undervalued small cap concerns delivering solid growth despite the challenging economic environment.

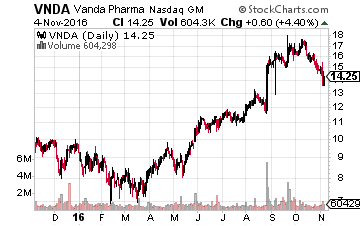

We last touched on Vanda Pharmaceuticals (NASDAQ: VNDA) in late September. The company delivered very strong third quarter results this week. Instead of losing a dime a share as expected, the company posted a profit of 11 cents a share. Revenue was also up more than 35% from the same period a year ago. The company now looks like it could be profitable in FY2017. I expect some positive analyst commentary on this name over the next week. Vanda has a solid pipeline and over $140 million in cash and marketable securities on the balance sheet. Every growth investor should like this company’s growth trajectory especially since the company looks cheap at just a $600 million market capitalization.

We last touched on Vanda Pharmaceuticals (NASDAQ: VNDA) in late September. The company delivered very strong third quarter results this week. Instead of losing a dime a share as expected, the company posted a profit of 11 cents a share. Revenue was also up more than 35% from the same period a year ago. The company now looks like it could be profitable in FY2017. I expect some positive analyst commentary on this name over the next week. Vanda has a solid pipeline and over $140 million in cash and marketable securities on the balance sheet. Every growth investor should like this company’s growth trajectory especially since the company looks cheap at just a $600 million market capitalization.

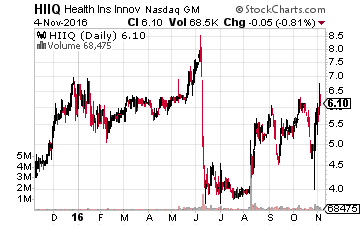

Healthcare Insurance Innovations (NASDAQ: HIIQ) continues to deliver outstanding results. The company reported after the bell Wednesday with an almost 80% rise in year-over-year revenues. Earnings per share came in at 33 cents, triple the consensus. It was the sixth straight quarter the firm has easily exceeded bottom line expectation. If the Republicans hold on to both the House and Senate, this is a company that should benefit as well given that any new regulations and legislation on the healthcare sector would most likely impede some of the growth of its niche healthcare insurance products.

Healthcare Insurance Innovations (NASDAQ: HIIQ) continues to deliver outstanding results. The company reported after the bell Wednesday with an almost 80% rise in year-over-year revenues. Earnings per share came in at 33 cents, triple the consensus. It was the sixth straight quarter the firm has easily exceeded bottom line expectation. If the Republicans hold on to both the House and Senate, this is a company that should benefit as well given that any new regulations and legislation on the healthcare sector would most likely impede some of the growth of its niche healthcare insurance products.

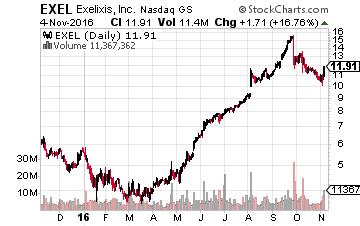

Exelixis (NASDAQ: EXEL) continues to see exponential growth powered mainly by oncology compound CABOMETYX. Net product revenue in the third quarter 2016 jumped from under $7 million in the third quarter of 2015 to over $42 million. CABOMETYX is also showing good results in mid-stage studies that could expand the amount of indications the compound could be approved for treating. Given the activity in the oncology M&A space over the past two quarters, an investor should also have this name on their possible buyout “watch list”.

Exelixis (NASDAQ: EXEL) continues to see exponential growth powered mainly by oncology compound CABOMETYX. Net product revenue in the third quarter 2016 jumped from under $7 million in the third quarter of 2015 to over $42 million. CABOMETYX is also showing good results in mid-stage studies that could expand the amount of indications the compound could be approved for treating. Given the activity in the oncology M&A space over the past two quarters, an investor should also have this name on their possible buyout “watch list”.

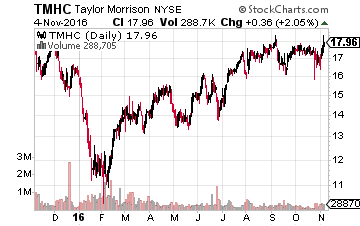

Home builder Taylor Morrison (TMHC) delivered more modest quarterly results. The company produced 49 cents a share of profit, three cents above expectations on a better than seven percent year-over-year increase in sales. New home orders were up 19% from the same period a year ago, so revenue growth should see a boost in the quarters ahead. The stock is still cheap at nine times next year’s projected earnings. I also continue to like LGI Homes (NASDAQ: LGIH), which is even cheaper and reports quarterly numbers next week.

Home builder Taylor Morrison (TMHC) delivered more modest quarterly results. The company produced 49 cents a share of profit, three cents above expectations on a better than seven percent year-over-year increase in sales. New home orders were up 19% from the same period a year ago, so revenue growth should see a boost in the quarters ahead. The stock is still cheap at nine times next year’s projected earnings. I also continue to like LGI Homes (NASDAQ: LGIH), which is even cheaper and reports quarterly numbers next week.

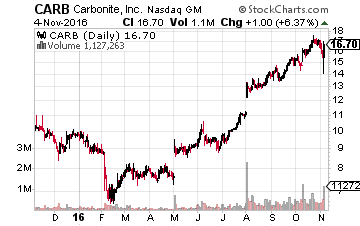

I took a small stake in data backup play Carbonite (NASDAQ: CARB) earlier this year when the market was falling apart to begin 2016. I wish I would have bought more as all the shares have done is doubled since then. The company certainly is delivering for shareholders and just reported earnings of 14 cents a share for the third quarter, double what the consensus was expecting on a 50% year-over-year rise in revenues, which was also above expectations. This was the third quarter in a row that Carbonite has easily topped both top and bottom line estimates. I think this is a solid long-term growth play. I don’t know if I would be chasing the name here, but I would put it on my “radar” to buy during any decent pullback in the market.

I took a small stake in data backup play Carbonite (NASDAQ: CARB) earlier this year when the market was falling apart to begin 2016. I wish I would have bought more as all the shares have done is doubled since then. The company certainly is delivering for shareholders and just reported earnings of 14 cents a share for the third quarter, double what the consensus was expecting on a 50% year-over-year rise in revenues, which was also above expectations. This was the third quarter in a row that Carbonite has easily topped both top and bottom line estimates. I think this is a solid long-term growth play. I don’t know if I would be chasing the name here, but I would put it on my “radar” to buy during any decent pullback in the market.

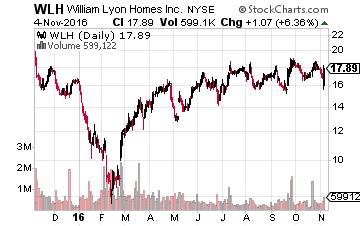

The shares of homebuilders have dropped some 15% over the past six weeks or so even as the housing recovery is still advancing in a two steps forward/one step back fashion. I have added a small home builder called William Lyon Homes (NYSE: WLH) to my portfolio in recent weeks. The western-based builder just saw over 35% year-over-year revenue growth in its third quarter numbers and the company is set up for substantial earnings growth in 2017 as well. Citigroup recently mentioned William Lyon as a possible acquisition target as the industry consolidates. In addition, insiders have been consistently accumulating additional shares over the past year. At under seven times next year’s consensus earnings per share, the stock is significantly undervalued.

The shares of homebuilders have dropped some 15% over the past six weeks or so even as the housing recovery is still advancing in a two steps forward/one step back fashion. I have added a small home builder called William Lyon Homes (NYSE: WLH) to my portfolio in recent weeks. The western-based builder just saw over 35% year-over-year revenue growth in its third quarter numbers and the company is set up for substantial earnings growth in 2017 as well. Citigroup recently mentioned William Lyon as a possible acquisition target as the industry consolidates. In addition, insiders have been consistently accumulating additional shares over the past year. At under seven times next year’s consensus earnings per share, the stock is significantly undervalued.

Something that amazes me about the market right now is that never has there been a time in history where an investing strategy has gained so much popularity right at the time when it could be most dangerous to an investors’ portfolio. What I’m talking about is a strategy that has caught on like wildfire for the majority of Americans who hire professional money managers and invest their money by themselves.

This is also a strategy that would overlook investing directly into these small growth stocks that offer huge return potential because of their exposure to some of the economy’s fastest growing sectors. The strategy I’m talking about is called ‘Passive Investing’ which means putting money into a market-weighted portfolio or fund that tracks the returns of a specific sector. but what if stock market returns are nothing like what they used to be over the next 10 years?

But what if stock market returns over the next 10 years are nothing like what they used to be?

In fact, that’s exactly what many investing experts are saying, and it could put ‘Passive Investors’ way behind on their retirement savings.

What you and every other investor in the market need to be doing right now is only purchase the stocks with the utmost best growth prospects in the market for the next 10 years. It sounds like a breeze, but even with my decades-long investing career it still takes me weeks or longer to find the right stock that fits all of my criteria for a good investment.

That’s why I started my Growth Stock Advisor newsletter, to provide a window to the public that looks directly into my personal portfolio of the market’s best growth opportunities both large and small. It’s a way for me to share my experience as a lifelong investor and former hedge fund manager to a select group of people serious about transforming their wealth and making the right moves with their money.

Just this last week, I released a new report that I’ve titled ‘5 Buyout Candidates to Double Your Money Overnight‘ that details my highest-conviction growth plays in a hot sector of the market. You can have this report plus my 20 stock portfolio of the top growth plays in sectors across the market and in companies both large and small if you give my Growth Stock Advisor a 60-day risk-free test drive. Just use the link below to find out more.

Click here to see my ‘5 Buyout Candidates to Double Your Money Overnight’

Positions: Long CARB, EXEL, HIIQ, LGIH, TMHC, WLH

Category: Penny Stocks On The Move