3 Small-Cap Stocks To Buy For Explosive Gains This Year

The long-term potential behind these three small-cap stocks outweighs most of their risk

The long-term potential behind these three small-cap stocks outweighs most of their risk

Small-cap stocks can be a tempting endeavor. Because of their small market caps and oftentimes low prices, investors are optimistic about their potential. While it’s wrong to buy a stock simply because its share price is low (buying 200 Fitbit Inc (NYSE:FIT) shares instead of one share of Alphabet Inc (NASDAQ:GOOG, NASDAQ:GOOGL) for instance), small caps can offer out-sized rewards.

Small-cap stocks are often categorized as having a market cap between $300 million and $2 billion. Even on the larger side, $2 billion is still pretty small.

Consider for example that Apple Inc. (NASDAQ:AAPL) has an $825 billion market cap. That’s a massive, massive company — one that is technically bigger than a lot of countries. With dozens of professional analysts, fund managers and retail investors all pouring over the same information, it can be hard to find an edge.

With small caps though, investors don’t run into as many conflicting signals. If they happen to find a stock with a solid product and good fundamentals, it could even be a takeover play. So let’s take a closer look at a few small-cap stocks to buy.

Small-Cap Stocks to Buy: Childrens Place (PLCE)

So far in 2017, shares of Childrens Place Inc (NASDAQ:PLCE) are up 7.5% — not bad for a retailer. And while PLCE stock is up more than 30% over the past year, it’s mostly been treading water since mid-November.

Childrens Place is one of the rare retailers to not have felt the full wrath of Amazon.com, Inc. (NASDAQ:AMZN).

Department stores, apparel makers and countless other retailers have been under a heavy barrage of fire over the past few years thanks to the rise of e-commerce. However, several retailers have bucked the trend.

Notably, these include discount retailers like TJX Companies Inc (NYSE:TJX) and Burlington Stores Inc (NYSE:BURL), home improvement companies like Lowe’s Companies, Inc. (NYSE:LOW) and Home Depot Inc (NYSE:HD), and specialty retailers like Ulta Beauty Inc (NASDAQ:ULTA).

So what exactly sets Childrens Place apart? Perhaps it’s the fact that young children are constantly in a growth phase. As parents, we never know what’s going to fit them now, let alone in a few months. So we need to bring them into the stores and have them try clothes on. That and a great selection of products has been the winning recipe.

CEO Jane Elfers has done a terrific job. While revenue results of $373.6 million missed analysts’ estimates last quarter and grew just 0.6% year-over-year, earnings were a different story. 86-cents-per share smashed expectations of 75-cents-per-share, while comp-store sales grew 3.1%. Margins also expanded during the quarter. That’s pretty good in this environment.

PLCE continues to grow, perhaps not robustly, but it’s indeed growing. PLCE stock pays out a 1.5% dividend yield, which isn’t great, but it’s also worth noting that in March, management doubled this payout. Because of its essentially stagnant stock price over the past 10 months, PLCE has seen its price-to-earnings ratio dive as well.

Now trading at just 15.5 times trailing results and 13.7 times next year’s estimates, the stock looks cheap. Its trailing ratio of 15.5 times is down from the 23 times it traded at earlier this year. In fact, PLCE stock now trades at its lowest P/E ratio in six years. While sales are expected to grow just 2.5% in 2018, earnings should balloon more than 35% from 2017 to 2018. From there, high single-digit earnings growth is expected.

Given PLCE’s low valuation, shares look attractive.

Small-Cap Stocks to Buy: GoPro (GPRO)

Understandably, GoPro Inc (NASDAQ:GPRO) has been a controversial stock since going public. I’ll spare you the history lesson, but any stock that falls from $88 to $8.80 is bound to catch the public eye.

Could things finally be turning around for the struggling hardware maker?

In Early August, GPRO beat earnings-per-share and revenue expectations as it grew sales by 34% YOY. It’s the first top- and bottom-line beat GoPro has registered since July 2015.

GoPro recorded its highest net income in 2014, saw margins and income contract in 2015 as it hit record revenues and watched its income statement ultimately bite the dust in 2016. 2017 should be different, though.

Already two quarters into the fiscal year, analysts expect GPRO to lose just 5-cents-per-share this year (up big from the $1.44 it lost last year) and for it to register $1.33 billion in sales, up 12.5% from last year.

However, those estimates could come up short. So far, management has topped revenue estimates by 7.3% in the first two quarters, while earnings losses of 5-cents-per-share last quarter came in vastly ahead of the 21 cent-per-share loss analysts were looking for. In 2018, forecasts call for 23-cents-per-share in profit and an additional 4% gain in revenue.

Operating cash flow (OCF) was not positive in 2016, despite positive results in 2013-16. So far in 2017, OCF remains in negative territory. Hopefully the holiday season is able to reverse that trend, though. While GoPro certainly has a lot to prove, hopefully management has learned a few valuable lessons thus far.

Additionally, GoPro has two new products coming out this year: The Hero 6 action camera and Fusion 360 degree camera. The Fusion could be a catalyst for GoPro should virtual and augmented reality trends really kick into high gear.

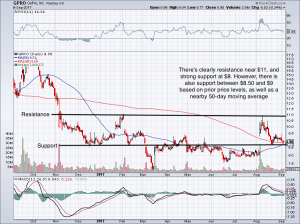

After the latest earnings report, GPRO stock surged from $8.25 to $10.75 in just a few days. Since then though, the stock is back in the $8 range. Investors who believe in the turnaround, but don’t want to risk too much can buy GPRO stock and use a stop-loss near the August lows around $8.50.

Small-Cap Stocks to Buy: BlackBerry (BBRY)

With its $4.75 billion market cap, BlackBerry Ltd (NASDAQ:BBRY) doesn’t exactly count as a small cap stock. But for many, it’s close enough.

The former smartphone maker — how weird is that, by the way? — has had several years to lick its wounds after tumbling down the smartphone mountaintop. Shares are down over 90% in the past nine years, but maybe now they’re finally worth a look.

Like GPRO, BBRY stock rallied on optimism and it has fallen once again. Shares rallied from sub-$7 levels in the spring to more than $11 after Citron’s Andrew Left said shares could go to $20 in the next two years as he drew similarities between BBRY and Nvidia Corporation (NASDAQ:NVDA).

While optimism ran strong into June, BBRY stock has since come back to earth, falling to $9.

Last quarter, BlackBerry announced it would buy back roughly 6.4% of its outstanding float. It seems like BBRY could find something better to do with this money. For instance, all the recent hype surrounding the company is centered on cyber security related to self-driving vehicles. It would seem prudent of BBRY to pour its excess cash into this business to make sure its product is so great that no company can go without it.

At least, that’s what it seems a company should do after it has fallen so far from the top. While this management of cash is debatable, investors can take comfort in CEO John Chen’s recent comments that BlackBerry should be free-cash flow positive for the year. This is excluding the $940 million settlement it received from Qualcomm, Inc. (NASDAQ:QCOM).

With cash flow headed in the right direction, profitability nearby and revenue likely near a bottom, BBRY stock could have upside from current levels. Particularly if the company is able to accelerate any of these metrics more quickly than the Street currently expects.

Bret Kenwell is the manager and author of Future Blue Chips. As of this writing, he did not hold a position in any of the aforementioned securities.

Also From InvestorPlace:

- 10 Dividend Stocks That Will Pay Your Monthly Bills

- 8 REIT ETFs to Buy for Massive Long-Term Gains

- 7 Turnaround Stocks and ETFs Charging Higher

Category: Small-Cap Stocks