The 3 Golden Rules Of Successful Biotech Investing

If you want to invest successfully in one of the few sectors where 1,000% gains are anything but unusual, follow these three “golden rules” that Bret Jensen has developed over his decades-long career.

If you want to invest successfully in one of the few sectors where 1,000% gains are anything but unusual, follow these three “golden rules” that Bret Jensen has developed over his decades-long career.

The 45th President of the United States will be inaugurated this week and the stock market has started out 2017 on much less volatile footing than the first few weeks of last year. Despite a rough start in 2016, Brexit and the unexpected November election results turned out to be a positive for investors as all the major indices closed out 2016 nicely in the black.

One sector that did not participate in last year’s gains was biotech, which dropped just over 20% on the year. This is the time of the year that individuals are well on their way to implementing their New Year’s resolutions, procrastinating on getting started, or completely giving up on them. If one of your “resolutions” was to become a better investor in the biotech sector, here are some observations, rules and tips for investing in this highly lucrative but extremely volatile part of the market.

A Different Beast:

The small cap part of biotech is unlike any other part of the market. For one thing, risk management is different than almost all other areas of the market. Stop losses simply don’t work in this space. If a small retailer reports disappointing holiday sales, it can easily lose 10% of its value that day. If a small tech stock misses earnings by a nickel a share, it could fall 15%. If a small biotech has its lead drug candidate fail in late-stage trials, it can gap down 60% or more, making your stop loss worthless and little more than a device that delivers only a false sense of security.

Option premiums are also too high to make them available for risk mitigation. The only risk mitigation strategy that works in this space is diversification, which means small stakes in multiple promising but speculative concerns. One must simply accept the fact that no matter how diligent you are, your portfolio is going to have some “strikeouts”, as it is the only way to garner the occasional “grand slam” that makes the sector so lucrative.

Here are a few tips to help try to hold those strikeouts to a minimum.

The Ten-Year Rule:

I wish I would have developed this rule much earlier in my investment journey in the biotech space. It would have avoided many painful implosions over the years. The rule simply states that any small biotech concern that has not had one drug approved and found some commercial success within its first decade as a public company probably never will.

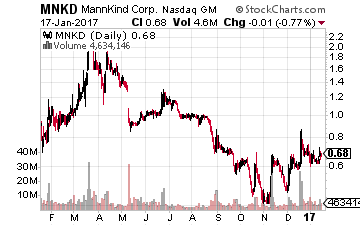

Unfortunately, there is a lot of hyperbole and “hopium” in this part of the market. Some companies are much better in raising investors’ hopes and gathering additional funding via secondary offerings than in advancing their pipelines. Mannkind (NASDAQ: MNKD) is a good poster boy for this rule. I have been hearing about the promise of this company for many, many years. As you can see all of this “promise” has yet to pan out, and probably never will.

Unfortunately, there is a lot of hyperbole and “hopium” in this part of the market. Some companies are much better in raising investors’ hopes and gathering additional funding via secondary offerings than in advancing their pipelines. Mannkind (NASDAQ: MNKD) is a good poster boy for this rule. I have been hearing about the promise of this company for many, many years. As you can see all of this “promise” has yet to pan out, and probably never will.

Stemcell (NASDAQ: STEM) was another great example of this rule. The stock once traded over $60 a share in the mid-2000’s. It was bought out for less than a buck a share last year, still without producing anything notable.

Shots on Goal:

Any good financial advisor will always tell you not to put “all your eggs in one basket”. The same is true in investing in a small developmental biotech concern. I always want to see a couple of promising drug candidates or “shots on goal” in the pipeline, or at least one solid drug candidate that is being developed for many possible indications. Investing in a small company with one drug candidate being aimed at one primary indication is strictly a binary play. It is either going to be a “home run” or one giant “swing and a miss”. Investors should be well-aware of those binary outcomes before they invest in a “one trick pony”.

The Jensen Rules:

As dire as some of the advice above has been, always remember that when you do catch a “winner” in this space, returns can be more outstanding than any other sector. However, it is important not to get greedy, maintain discipline and cull some profits when you are aboard this type of rocket. Over the years, I have developed the “Jensen Rules” for such occasions.

They go like this:

If you buy 1,000 shares of a small cap stock:

If the equity goes up 50%, sell 100 shares.

If the stock doubles, sell another 200 shares.

If the shares triple, sell another 200 shares.

You now have locked in a guaranteed profit even if the stock goes to zero. You also have 50% of the original stake riding on the “house’s money”, one of the best free rides there is.

And on that note of optimism, we close out our look on how to be better investors in the small biotech space in 2017.

My Biotech Gems service is the perfect way to easily invest in some of the market’s top biotech stocks, all fully vetted and researched for you. Don’t wait, as these oversold levels won’t last long. Click the link below to learn how Biotech Gems can help you profitably invest in one of the market’s most lucrative sectors.

Click here to find out more about Biotech Gems.

Category: Biotech Stocks