Tim Plaehn’s Top 2 Dividend Stock Picks For The New Year

Last year’s picks shot up 30% and 99% over the last 12 months and his next two have just as exciting growth potential in the coming year. If you want to own stocks for income but also want some shares with good upside potential, take a look at Tim’s two favorite picks for 2017.

Last year’s picks shot up 30% and 99% over the last 12 months and his next two have just as exciting growth potential in the coming year. If you want to own stocks for income but also want some shares with good upside potential, take a look at Tim’s two favorite picks for 2017.

By invitation, I am a regular presenter at the various MoneyShow investor conferences. At one of the multi-day conferences, I typically make two or three presentations to packed crowds. For the last several years I have been asked to submit a couple of stocks for the annual MoneyShow Top Picks feature.

2017 will be the 34th year of existence for the list of picks from a wide range of stock market experts, and my selections are part of the MoneyShow’s annual survey. If you want to see what other experts are recommending for next year, the Top Picks will be running over a three-week period at MoneyShow.com, beginning on Thursday, January 5th.

2017 will be the 34th year of existence for the list of picks from a wide range of stock market experts, and my selections are part of the MoneyShow’s annual survey. If you want to see what other experts are recommending for next year, the Top Picks will be running over a three-week period at MoneyShow.com, beginning on Thursday, January 5th.

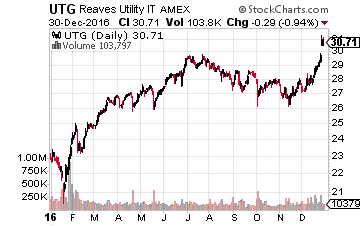

Last year, as a conservative investment I recommended the Reaves Utility Income Fund (NYSE:UTG). For the 2015 market close through December 27, 2016, UTG produced a 29.5% total return for investors.

Last year, as a conservative investment I recommended the Reaves Utility Income Fund (NYSE:UTG). For the 2015 market close through December 27, 2016, UTG produced a 29.5% total return for investors.

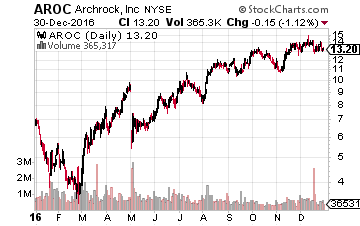

My aggressive recommendation was Archrock Inc. (NYSE:AROC), an energy sector midstream service provider. At the end of 2015, there were a lot of severely beaten down energy midstream stocks. At that time, AROC was still growing revenues and had good prospects to continue with moderate growth into 2016. The stock turned out to be a pretty good pick, returning 98.5%, including dividends, to investors in 2016 through December 27.

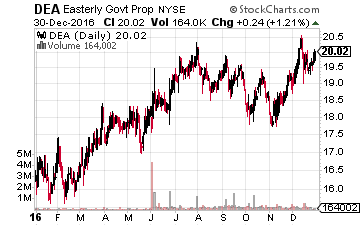

My 2017 Conservative Income Stock Pick: Easterly Government Properties Inc. (NYSE:DEA)

Easterly Government Properties is a small cap REIT, with a current $700 million market cap. The company was formed in 2011 by a group of executives with an average of 25 years of commercial real estate management experience.

Easterly Government Properties is a small cap REIT, with a current $700 million market cap. The company was formed in 2011 by a group of executives with an average of 25 years of commercial real estate management experience.

Easterly went public with a February 2015 IPO. At the time of the IPO, Easterly owned 29 properties that were 100% leased, with 26 leased by federal agencies.

Management’s goal is to acquire properties to lease to government agencies. Criteria include buying buildings that are less than 20 years old (the average government facility is almost 50 years old) and put them on 10 to 20-year leases with built-in rent increases.

The General Services Administration (GSA) sets up almost all government leases and is moving the federal government away from owned facilities. GSA leased square footage has grown by 29% since 1998 with owned asset size staying flat over the same period. Changing missions and technologies are also pushing agencies into newer buildings that better support department requirements.

Leasing to the GSA takes a high level of expertise to work through the government contracting process.

Currently, no landlord owns more than 3.4% of GSA-leased properties and the top 10 own about 18% of

government-leased properties. The handful of other REITs operating in the government buildings sector have stable portfolios but little growth potential.

Easterly, however, has come into the government leasing sector with more aggressive growth plans. The goal is to acquire $75 million to $125 million of properties per year to the portfolio to lease to government agencies. With a current enterprise value of about $850 million, that target equates to 10% to 15% annual growth. Since the IPO, the DEA portfolio has grown to 41 properties.

Easterly currently carries a low debt balance that equals 15% of enterprise value. Its peer REITs have debt levels of 40% to 50%. This means that Easterly can fund property acquisitions with more debt, which will increase the cash flow per equity share. Right now, the company is actively evaluating $300 million of potential acquisitions.

The fact that Easterly has its long-term leases with the world’s most financially safe client allows the use of moderate to high debt levels while still maintaining a secure balance sheet. Cash flow per share growth can come from a combination of acquisitions and increased financial leverage in the company. Dividends should grow at a 10% plus annual rate.

My expectations are that the combination of long-term government-guaranteed leases with an attractive growth profile will catch the investing market’s attention as Easterly Government Properties builds a track record. This level of growth plus safety could result in the market pushing the share price up and the yield down. If the yield goes to less than 4% we would see a mid-$20’s share price. Currently, DEA trades for about $19.90 and yields 4.8%.

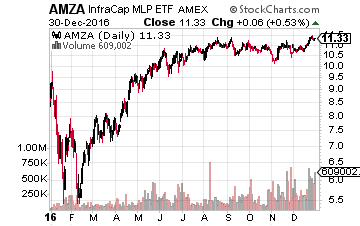

My 2017 Aggressive Income Stock Pick: InfraCap MLP ETF (NYSE: AMZA)

I am forecasting that the energy midstream and infrastructure sector will again be a growth sector in 2017 and that there is lots of upside potential in the group. The MLP and other energy service company stocks experienced a bear market in 2015. They then stabilized their business operations in 2016, and now, in 2017, investors should realize very attractive returns from the quality companies in the sector. Instead of trying to pick one stock in the group, I am recommending one of the more aggressive MLP focused ETFs.

I am forecasting that the energy midstream and infrastructure sector will again be a growth sector in 2017 and that there is lots of upside potential in the group. The MLP and other energy service company stocks experienced a bear market in 2015. They then stabilized their business operations in 2016, and now, in 2017, investors should realize very attractive returns from the quality companies in the sector. Instead of trying to pick one stock in the group, I am recommending one of the more aggressive MLP focused ETFs.

AMZA is the first actively managed ETF in the MLP focused funds space. Here is how the InfraCap MLP ETF is designed to operate. The fund owns the same MLPs as the ones tracked by the Alerian MLP Infrastructure Index, with the following possible enhancements to the index:

- The fund manager can weight individual MLPs holdings differently than the index. The AMZA is strictly market cap weighted, tracking the 25 largest midstream MLPs, with bigger MLPs having a greater weight on fund performance.

- AMZA will weight these same MLPs based on the return potential from the management team’s proprietary algorithm.

- The fund can own the publicly traded general partner companies of the index component MLPs. The general partner of an MLP can generate an accelerated level of cash flow growth compared to the limited partnership it manages. The GP companies can produce extra capital gains for the fund and a faster-growing distribution cash flow stream.

- The fund can sell call options (covered call strategy) to generate extra cash income from the portfolio.

- Fund managers can use a moderate amount of leverage (up to 33% of the portfolio). Leverage in an MLP fund helps offset a portion of the corporate income tax drag.

Fund assets have grown tremendously this year, currently $135 million, compared to about $19 million at the start of 2016. The rapid growth in assets provides some challenges for the fund managers but is very good news for us investors for the long-term. The popularity has been due to the high dividend yield. The fund managers have used covered call income to supplement the distribution cash flow from the MLP holdings.

The quarterly dividend has been steady since the fund was launched in late 2014. However, the share price has declined with the drop in MLP values. The result is an ETF that now yields 18%. I have regular contact with the fund managers, and they believe they can sustain the high dividend. In 2017, AMZA should produce double barrel profits and a very high dividend yield. This is combined with a strong recovery in MLP unit values.

Stocks that have a high current yield and the potential for dividend growth are an integral part of my income investing strategy that I share in my newsletter, The Dividend Hunter. This is where I recommend the market’s strongest, most stable high-yield dividend payers, and there are 20 high-yield stocks currently available through my Monthly Dividend Paycheck Calendar system for generating a high monthly income stream from the market’s most stable high-yield stocks.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks every month and in some months up to 12 paychecks from reliable high-yield stocks built to last a lifetime.

The next critical date is Wednesday, January 4th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $3,448.80 in payouts by February, but only if you’re on the list before January 4th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: Penny Stock Alerts